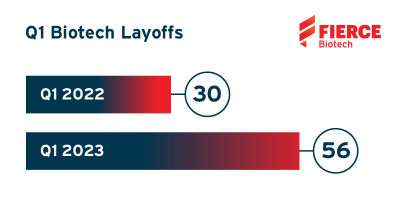

In the first quarter of 2023, 56 biopharmas laid off staff—an 87% jump compared to 2022, when 30 companies reported layoffs for the same period, according to a Fierce Biotech analysis.

“That number is a little staggering,” Darren Nelson, founder and CEO of Recruits Lab, a hiring agency that works with biotechs, told Fierce Biotech.

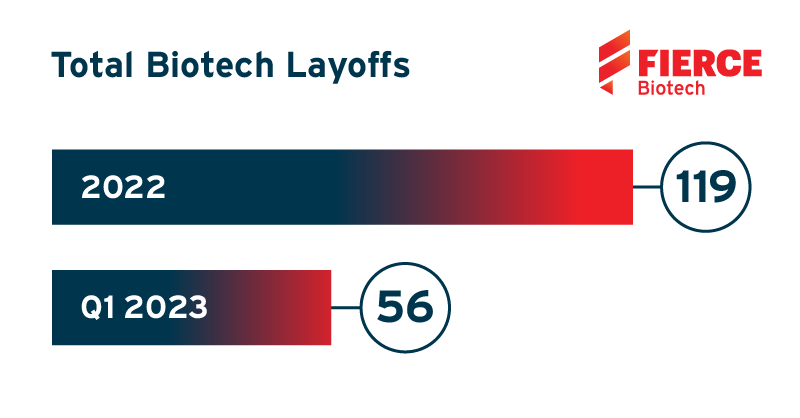

The layoffs to date equal almost half of all workforce reductions that occurred throughout 2022, with 56 companies taking this route in the first quarter compared to 119 recorded for all of last year, according to data from Fierce Biotech’s Layoff Trackers for 2022 and 2023.

Among the three months that make up quarter one, February—the shortest month—had the highest number of layoffs, with 23 companies making cuts in 28 days. The surge came as companies reported end-of-year earnings results, when many biotechs had to grapple with cash burn and low return on investments. The staff reductions then slowed a bit in March, with 19 companies slimming their workforces.

While it's difficult to calculate the true human impact from all of these cuts, we know at least 1,445 employees were laid off from 18 companies that reported actual numbers of team members impacted in the first quarter. The remaining 38 companies included in the Fierce Biotech Layoff Tracker either reported layoffs as a percentage of the workforce to be cut or did not disclose how many staff members would be laid off.

“Biotech got hit early with this malaise, and so I don't think it can get terribly worse,” Sci.bio Recruiting founder Eric Celidonio said in an interview.

2023 follows a year defined by aggressive rate hikes from the Federal Reserve and declining VC investment after the industry experienced unsustainable demand and funding highs tied to the pandemic. Biopharma lived in a bubble during 2020 and 2021, high on “COVID mania,” as Celidonio calls it.

“It just went up too quickly,” Celidonio explained. “I think this is just a reversion back to the mean, but an over swing back there, and it'll slowly kind of get back to a normal state, I would say towards the end of the year.”

The fall from COVID mania prompted poor IPO prospects, sparse M&A activity and layoffs. These tough decisions have played out in boardrooms across the industry. While the decision-making process isn't always public-facing, sometimes executives offer a glimpse at what goes on behind the scenes.

NGM Bio's CEO David Woodhouse, Ph.D., recently described the struggles the oncology biotech faced that ultimately led to a 33% workforce reduction in a Securities and Exchange Commission disclosure announcing the cuts, which were revealed at the beginning of the second quarter.

“Raising capital has become increasingly difficult for companies in our industry over the last couple of years,” the CEO wrote in the letter to staff. The solid-tumor-focused biotech eliminated 75 roles in light of the difficult financing climate and in response to the failure of a phase 2 trial in October 2022, according to Woodhouse.

Many biotechs have had to make similar decisions as NGM, while others have had to go even further. Small drug discovery biotech Vyant Bio and gene-therapy-focused Coda Biotherapeutics announced they would shut down completely in the first quarter.

A banner year for Big Pharma—despite layoffs

If biotech got hit early, Big Pharmas were late to the game, with names like Johnson & Johnson, Amgen, Pfizer, Bayer, Novo Nordisk and Roche’s Genentech only recently being pulled into the layoff whirlpool. But workforce reductions at the big organizations aren’t necessarily the same indicators of company health that they are for biotechs.

In December, Celidonio told Fierce Biotech that industry employment was buoyed by Big Pharma openings as layoffs struck smaller companies, a thesis he still stands by, noting that layoffs are mostly “housecleaning” activities for the majority of pharma giants.

“Last I checked, it was a pretty banner year for Big Pharma last year,” Celidonio said. Core products like blood pressure meds will always be in demand, while the larger companies have benefited from boosts in COVID-19 vaccines and therapeutics. "It's going pretty well for them.”

Money is still being spent by pharmas for newly commissioned sites, M&A deals and venture arm investments to help build portfolio companies, he said. Big Pharma is just doing “what any mature industry does,” according to Celidonio: getting rid of more expensive, less productive people.

Often pharma giants are adding more people than they're laying off, they're just doing it under the banner of M&A.

“They don't need the big, bloated workforces anymore,” Celidonio said. “They need nimble little units that can develop drugs quickly.”

'Pie in the sky'

While Big Pharma’s predicament is a far cry from the blight biotechs face, one similar pattern emerged between the two. Across the board, preclinical work and R&D roles are more likely to come under the ax than other positions.

“You're seeing a lot of pipeline research get cut,” Celidonio said, noting a renewed focus on advancing programs that are further along in development and avoiding investments for “pie in the sky” discovery work. Administrative and operational roles are also being consolidated.

Nelson said there are few research roles opening up, but companies that are adding are likely bringing on sales roles—positions that drive income.

While there may still be a painful road ahead, the most innovative biotechs will be the ones left standing, according to Nelson.

“Companies that have the edge will still be ahead of the curve,” he concluded.

And, despite the volatility of the sector—which Celidonio says is one of the most volatile of all industries—he believes the industry is maturing. Biotech is bringing drugs to the market much faster than before, which makes it more investable and, in theory, less volatile.

“Some of these innovative new therapies—gene therapy, for instance—have a huge amount of promise to patients that have no other alternatives,” Celidonio said. “That’s worth a lot, so people will pay for it.”