Editor's Note: When we launched the Fierce Biotech Layoff Tracker, we hoped it would be a short-lived project. But the biotech markets were brutal throughout 2022, and so our team updated near daily with staff reductions as the industry reeled.

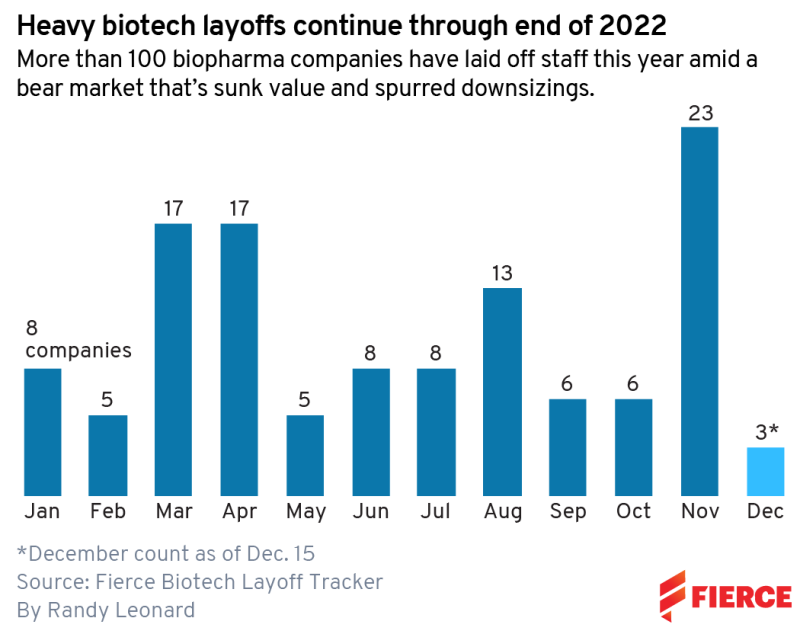

We recorded 119 total layoffs among biotech companies in 2022. They came in clusters. Some days we’d have three or four, others just one or none. But the trend was undeniably relentless—and, we imagine, especially difficult to those staffers who lost their jobs. November was the toughest month of the year with 23 and December the slowest, with just 3 as of December 15.

The time has come to officially retire the Tracker—at least this edition of it. We don’t believe this trend is over and suspect that the fourth quarter/full year earnings reporting season could see some rough times to come for biotechs.

We plan to relaunch a new version should the reductions continue, but for now, see below for a look at our chart showing the ebbs and flows of layoffs this past year.

As always, if you know of a layoff occurring at a biotech, please reach out to the Fierce Biotech editorial team and let us know. We will continue to cover layoffs in the industry with the same comprehensiveness.

— Senior Editor Annalee Armstrong

The pace of biotech layoffs is coming so fast that even we at Fierce Biotech could not write our feature on the issue fast enough to encapsulate them all. As we hit publish on our story, more companies announced they were letting staff go.

Every single day, we’re seeing new companies announce that, regrettably, they will have to cut back on head count. C-suites have not been immune, either, with a few companies relieving key leaders of their duties as they restructure to face a tumultuous market and make or break regulatory or research moments.

So today, we’re launching our Fierce Biotech Layoff Tracker. We’re starting from Jan. 1 of this year, and we’ll see where it goes. If you have information about a layoff happening at a biotech, please let us know and we’ll check it out.

See our recap of the top 10 most game-changing cuts of the first half.

December —3 companies total

Dec. 15, 2022: Axcella: Almost all of the Axcella team is headed for the exits after the company ended work of its NASH program to focus on developing a long COVID therapy. All told, 85% of the company was laid off.

Dec. 8, 2022: Instil Bio: The biotech is calling it quits on its lead tumor-infiltrating lymphocyte therapy, a major overhaul that’s resulting in 60% of its staff getting laid off.

Dec. 6, 2022: MEI Pharma: Layoffs are hitting MEI Pharma after the company elected to discontinue ex-Japan development of its Kyowa Kirin-partnered lymphoma med, zandelisib. The smaller biotech says it will first cut staff tied to zandelisib development, representing at least 30% of the total workforce, but did not count out additional cuts to save more cash.

November—23 companies total

Nov. 30, 2022: SQZ Biotechnologies: As the biotech's CEO hits the exits, the company has announced a 60% staff reduction in tandem with a pipeline restructure. The company anticipates the cost-saving measures to extend the biotech’s cash runway into 2024.

Nov. 30, 2022: Synlogic: Along with pipeline culls, the synthetic biology company is slimming its workforce by 25%. The Massachusetts biotech lists 93 employees on LinkedIn, meaning a quarter cull would equate to about 23 people.

Nov. 30, 2022: Oncorus: The biotech has dropped its phase 1 herpes simplex virus drug being studied combination with Keytruda in solid tumors, a piipeline cull that triggered a 20% workforce reduction. The remaining employees will focus on developing a self-amplifying RNA product candidate dubbed ONCR-021.

Nov. 29, 2022: Codexis: The enzyme engineering company is laying off 18% of staff, which would equate to about 59 employees based on the company’s 329 staff members listed on LinkedIn.

Nov. 29, 2022: Sana Biotechnology: The Seattle-based biotech is letting go of 15% of its workforce and discontinuing development of a heart failure drug.The pared-back workforce and investment strategy is hoped to provide a cash runway over the next several years.

Nov. 25, 2022: Spectrum Pharmaceuticals: The biotech is ending the year as it started it—with a round of layoffs. A recent 75% reduction in its R&D workforce was prompted by a complete response letter from the FDA that provided the final nail in the coffin for Spectrum's lung cancer candidate Pozenveo.

Nov. 18, 2022: Synthego: After a comprehensive review, the company has implemented changes "to best position the company for long-term success in the current environment," including a 20% workforce reduction, a spokesperson told Fierce Biotech via email. That equates to 105 layoffs, according to a WARN notice filed Nov. 18.

Nov. 15, 2022: Rafael Holdings: The New Jersey company is laying off "under 10" employees, a spokesperson for Rafael told Fierce Biotech. Rafael expects to incur severance charges of about $500,000.

Nov. 15, 2022: Freeline Therapeutics: In order to prevent a financial freefall, Freeline Therapeutics has reduced its workforce by roughly 23%, or 30 employees. The company says it will have roughly 100 employees by the end of the year.

Nov. 14, 2022: NexImmune: With its eyes set on new pipeline priorities, NexImmune is laying off 30% of its staff, primarily those working on its once-lead AIM ACT program. Instead, the company says its pivoting to focus on its AIM INJ injectable immunotherapy.

Nov. 14, 2022: Tricidia: With the corporate walls seemingly closing in quickly on Tricidia, the company is trimming its staff by more than half to stay afloat. The company has also retained a couple of advisors to help find an escape hatch, likely in the former of a sale or merger.

Nov. 14, 2022: Harpoon Therapeutics: Harpoon is releasing a number of preclinical projects back into the ocean to focus time and resources on ongoing clinical assets. As a result, the company is cutting its staff by 45%, primarily those in "research and supportive functions."

Nov. 14, 2022: Neoleukin: The list of IL-2-targeting treatments that have fallen by the wayside continues to grow, with Neoleukin deciding to ax development of its one and only clinical asset NL-201. As a result, the company laid off 40% of its staff to stay financially afloat.

Nov. 14, 2022: Adamis: A month after saying layoffs were on the table, Adamis is trudging ahead with staff reductions, although the exact downsizing is unknown. The company disclosed that it had undertaken "employee headcount reductions" as part of "significant expense reduction measures."

Nov. 10, 2022: Passage Bio: After trimming its staff by 13% in March, Passage Bio turned to layoffs once more, cutting 23% of its staff. In a LinkedIn post, the company's executive director of human resources said that the move impacted 25 employees.

Nov. 10, 2022: Roivant Sciences: Roivant is trimming its staff by 12% as part of a larger strategy to extend its cash runway into the second half of 2025. One of the company's offshoot companies, Dermavant, recently nabbed FDA approval for its dermatology med.

Nov. 10, 2022: Curis: With a tough decision to make, Curis has opted to rally behind its leukemia and lymphoma med, shedding 30% of staff across R&D and administrative positions. Emavusertib will be the company's sole focus, as some new data hints that a new drug application could be in the near future.

Nov. 9, 2022: Clovis Oncology: The company has shared that it “will not have sufficient liquidity" to maintain operations beyond January 2023, and said a bankruptcy filing “in the very near term … looks increasingly probable," according to quarterly filings. The filings also revealed that Clovis laid off 115 U.S. employees to save cost, but the $29 million in annual savings won’t be fully realized until next year.

Nov. 8, 2022: Adaptimmune: Amid a flurry of pipeline changes and setbacks, the company has disclosed that it will be laying off up to 30% of staff to extend its cash runway into 2025. The cuts are expected to be completed in the first quarter of 2023.

Nov. 4, 2022: Repertoire Immune Medicines: The Flagship-founded biotech confirmed to Fierce Biotech that it had cut 45% of its staff, or roughly 60 employees. The company did not elaborate on what spurred the layoffs.

Nov. 4, 2022: Galapagos: The Paul Stoffels-helmed biotech has just made its second strategic announcement in six months, dropping more assets from its pipeline and laying off about 200 employees—about 14% of the company’s 1,400 workforce as of June.

Nov. 2, 2022: Rubius Therapeutics: The cancer and autoimmune focused biotech is axing 82% of its workforce in efforts to maximize shareholder value. The company's Chief Financial Officer Pepe Carmona and Chief Legal Officer Maiken Keson-Brookes are also both headed out the door.

Nov. 2, 2022: Surface Oncology: The biotech has paused work on its anti-tumor antibody, known as SRF617, citing the halt as the reason for a 20% staff cull. Halting work on SRF617, combined with the related layoffs, will help Surface extend its cash runway into the second quarter of 2024.

October—6 companies total

October 18, 2022: Ambrx Biopharma: The San Diego-based biotech is narrowing its cancer pipeline to earlier-stage therapies and dumping its lead asset at the expense of 15% of its workforce.

October 14, 2022: Invivyd: The biotech formerly known as Adagio is culling commercial roles as a continued effort to distance itself from the struggles of its COVID-19 antibody. The newly announced “headcount changes” at the company will span “several corporate and commercial positions, among others,” Invivyd said in a release.

October 12, 2022: GreenLight Biosciences: The RNA-based biotech is undergoing a 25% workforce reduction that is anticipated to save around $13 million in 2023. The layoffs are part of a strategic realignment to focus on key near-term value drivers and extend the company's cash runway, and come despite an $109 million fundraise in August.

October 7, 2022: BioMarin: The large drugmaker is trimming its workforce by 4%, or 120 employees. The company’s decision was couched in the traditional language of simplifying the organization, creating efficiencies and reducing layers of management. But the real reason is that the move will save around $50 million a year from 2023 on.

October 6, 2022: Cyclerion Therapeutics: For the second time in two years, the biotech has shifted gears for its clinical development plans, pivoting to focus on mitochondria-related diseases. The reprioritization has resulted in 45% of staffers being shown the door, leaving Cyclerion with a head count of 16 full-time employees.

October 4, 2022: OncoSec Medical: In a bid to reduce operational expenses and extend its cash runway, the oncology company is laying off 45% of its employees—18 people in total. The company had $19.5 million in cash and equivalents as of the end of April, a drop from almost $46 million a year ago.

September—6 companies

September 27, 2022: Exicure: Months after an executive exodus shook Exicure, the company is once again laying off staff, the second time that's happened this year. The company announced it's shrinking its team by 66%. The downturn can be traced back to December 2021, when the company disclosed that a senior researcher misreported preclincal data. This time around, Exicure seems to be close to waving the white flag, as it's also halted all R&D work.

September 15, 2022: Palisade Bio: The biotech has cut 20% of its staff in an effort to stay afloat. All eyes now turn to LB1148, the company’s sole asset, which is being developed as a therapeutic to assist with postoperative GI function and prevention of post-surgical abdominal adhesions.

September 15, 2022: IMV: After being threatened with Nasdaq delisting in July, the oncology biotech has faced another blow: layoffs. IMV has initiated a significant strategic reorganization that will allow it to focus on its lead oncology asset at the expense of a third of its workforce. An IMV spokesperson didn't provide a precise figure of employees who would be affected, but said most departments will be impacted.

September 13, 2022: Rubius Therapeutics: After reviewing human data on its lead candidates, the cell therapy biotech concluded investment in its two clinical prospects “is no longer justified,” leading it to stop studies and lay off 75% of staff. Rubius ended January with 269 full-time employees, suggesting around 200 people will lose their jobs.

September 13, 2022: ObsEva: The Swiss company is restructuring, terminating 70% of its staff, including chief strategy officer Katja Buhrer. The cuts come after the FDA said in July that its highly touted uterine fibroids candidate linzagolix wasn’t fit for an on-time approval. The move will provide annual savings of $7.6 million, according to ObsEva.

September 1, 2022: Finch Therapeutics: The microbiome-centered biotech is showing 37% of its workforce the door. The layoffs come a week after Takeda’s decision to hand back the rights to two preclinical inflammatory assets that the companies had been collaborating on for years and is the second Finch workforce cut this year (see April).

August—13 companies

NEW—August 31, 2022: Mereo BioPharma: Under pressure from an activist investor, the U.K. biotech has reduced its head count to stretch its cash runway out into the second quarter of 2025.

August 30, 2022: Codiak BioSciences: The Massachusetts biotech has cut its workforce down to 53 full-time employees—a 37% reduction meant to reflect a new, smaller pipeline. The company is also seeking partnerships at both the corporate level and for specific clinical candidates.

August 24, 2022: PACT Pharma: The oncology biotech has suspended its lone clinical trial—a phase 1 study halted due to a "business decision"—and is diverting 54 employees towards a new "business development venture," according to CEO Scott Garland. The 54 staffers were originally part of the 94 slated to be laid off at the end of August.

August 24, 2022: Aeglea BioTherapeutics: After receiving a refusal-to-file letter from the FDA for its rare disease drug pegzilarginase, Aeglea has laid off 25% of its workforce. The biotech's CEO Anthony Quinn is also leaving the company.

August 18, 2022: Clarus Therapeutics: The Jatenzo developer has slashed staff by 40% and cut certain R&D projects as it grapples with debt, voicing “substantial doubt” about its ability to continue. As of June 30, Clarus had $19.2 million in cash and cash equivalents, and an accumulated deficit of $347.2 million.

August 15, 2022: Avanir Pharmaceuticals: The California biopharma has cut 16 employees, a 13% reduction from its current team of 115, according to a WARN notice obtained by Fierce Biotech. The permanent layoffs will be effective October 14.

August 9, 2022: Vedanta: CEO Bernat Olle blamed "a challenging economic environment in biotech" for letting go of 20% of the microbiome-focused company's workforce.

August 9, 2022: Absci: CEO Sean McClain published a message expressing his regret at a "workforce reduction." The biologics company did not disclose how many employees were affected when contacted by Fierce.

August 8, 2022: MacroGenics: After seven patients died in a phase 2 trial, MacroGenics is doing some restructuring, leaving 15% of staff without a job.

August 8, 2022: Atara: It's been a tough couple months for Atara Biotherapeutics after a mid-phase study for a multiple sclerosis cell therapy yielded inconclusive results, among other challenges. Now, 20% of staff are headed out the door as the biotech slims its R&D focus.

Zymergen: With the company's acquisition by Ginkgo announced in July, employees at Zymergen may have been hoping they would be spared from a planned reduction in headcount. But a WARN filing has since confirmed that 74 staff in California will lose their jobs at the biotech in September.

VBL Therapeutics: Less than two weeks after a top asset flunked a phase 3 trial, VBL Therapeutics is laying off 35% of its staff. But even as the company looks to stay afloat, finances remain tight, with available cash able to last another year.

Nuvation Bio: The biotech will not only discontinue development of one of its remaining tumor drugs but will lay off 35% of its workforce in a bid to keep the money flowing for another five years.

July—8 companies total

Assembly Biosciences: Accepting that its core inhibitor vebicorvir will fall short, the biotech is pivoting to earlier-stage candidates—and laying off 30% of staff to eke out its remaining cash.

X4 Pharmaceuticals: The immune system specialist is “streamlining resources,” resulting in a 20% staff reduction and the discontinuation of the biotech’s oncology program.

Inovio: The DNA medicine company has cut 18% of its workforce as it struggles to move a COVID-19 vaccine towards regulatory authorization. The restructuring will help extend the biotech's cash runway into 2024.

PACT Pharma: Nearly 100 employees were laid off from personalized cancer therapy maker PACT Pharma. The company most recently raised $75 million in a series C round that closed in 2020.

Eisai/H3 Biomedicine: The Japanese pharma is closing U.S. oncology R&D wing H3 Biomedicine and moving the work into a different organization in the company. As a result, 88 jobs were axed.

Biogen: After warning of future layoffs and restructuring for months, Biogen disclosed 301 jobs have been cut in recent months. In March, the company moved to “substantially eliminate” commercial infrastructure for the Alzheimer's med Aduhelm following a tumultuous rollout.

CytomX Therapeutics: In the wake of its antibody-drug conjugate praluzatamab ravtansine falling short in a phase 2 trial for triple-negative breast cancer, the biotech announced plans to reduce its 174-person headcount by 40%.

Adverum Biotechnologies: The gene therapy biotech is slashing its workforce by nearly 40%, cutting 78 employees under a new restructuring plan that will funnel resources to ixo-vec, its wet age-related macular degeneration (AMD) treatment candidate.

June—8 companies total

Heron Therapeutics: The biotech has cut 34% of its total workforce as part of efforts to save an annual $43 million. About 70% of the cuts will come from research and development jobs.

Avadel Pharmaceuticals: Looking to extend a $100 million cash runaway ahead of a potential commercial launch, Avadel is cutting nearly 50% of its workforce. The company projects the move could save up to $14 million each quarter.

Novartis: The large Swiss pharma is laying off 8,000 employees worldwide in a bid to save $1 billion. The cuts come as the company combines a number of business units, a plan that includes fusing the oncology and pharmaceuticals teams into one innovative medicines unit.

RedHill Biopharma: The Israeli biotech will lay off a third of its U.S. commercial team as it looks to claw back $50 million in savings.

Vincerx Pharma: The cancer-focused biotech blamed tough market conditions for the decision to lay off 33% of staff and trim the biotech’s clinical focus.

Praxis: Following the failure of a phase 2/3 trial in major depressive disorder, the biotech announced a "reduction of the company’s workforce and future operating expenses." More details as we get them.

Athersys: The stem cell biotech is going straight for the big ax, cutting 70% of staff and most of its C-suite after the stroke therapy MultiStem failed in a phase 2/3 trial in May.

Atreca: The oncology biotech plans to cull a quarter of its workforce, a move that includes both current employees and open positions. The cuts are part of a corporate reorganization announced June 1 that aims to fund the company through 2023.

May—5 companies total

Genocea: Less than a month after dwindling funds forced Genocea to ax 65% of its staff and seek out a sale, the company is officially closing up shop. The move means all remaining nonessential staff will be shown the door and the company will de-list from Nasdaq.

Applied Molecular Transport: The biopharmaceutical company is cutting 40% of staff, bringing its full-time workforce to 81 employees. AMT co-founder and Chief Scientific Officer Randall Mrsny, Ph.D., is also departing after more than a decade with the company.

Scholar Rock: The protein growth factor biotech is in a hard place, with plans to lay off 25% of staff, trim the pipeline and send CMO Yung Chyung, M.D., out the door.

Agios Pharmaceuticals: After offloading its cancer business and snagging an FDA approval for Pyrukynd, Agios is looking to shake up its R&D operations to focus more on later-stage assets. That means 50 employees will lose their jobs, while 50 other R&D personnel will remain to drive the new focus.

Spero Therapeutics: A tough call from the FDA on its urinary tract infection drug tebipenem HBr led Spero to announce it will lay off 75% of its staff. The cuts will reduce the biotech's headcount from a full-strength total of 146 to just 35 full-time employees.

April—17 companies total

Genocea Biosciences: A few weeks ago, Genocea Biosciences was touting phase 1/2 data. Now, 65% of the workforce is headed out the door and the biotech is looking to sell itself.

Solid Biosciences: Another biotech re-prioritization will cost staff at Solid Biosciences, as the company reduces its workforce by 30% to refocus efforts on two key Duchenne muscular dystrophy programs.

Nektar Therapeutics: After a $3.6 billion immuno-oncology partnership with Bristol Myers Squibb crumbled, Nektar has had to make some difficult choices. The company has gutted its workforce by 70% and two key executives will depart.

Black Diamond Therapeutics: After initially de-prioritizing a precision oncology drug in January, Black Diamond is calling it quits on the program. Along with a re-prioritization, the biotech will lay off 30% of its staff.

Imara: Only six employees will remain at Boston-based Imara after 83% of its staff are cut. The company is reeling from the discontinuation of development for lead drug tovinontrine, or IMR-687, in sickle cell disease, beta-thalassemia and heart failure with preserved ejection fraction.

Finch Therapeutics: After a collection of setbacks, Finch is letting go 20% of its workforce. The layoffs, which are expected to be complete by the end of the second quarter, will impact about 37 full time employees.

Sio Gene Therapies: The majority of staff at Sio Gene Therapies were let go during an all hands meeting, the biotech said April 27.

Magenta Therapeutics: Magenta is saying farewell to 14% of its staff as the company focuses on its targeted conditioning stem cell program as well as its mobilization and collection asset for sickle cell.

ProQR: Ophthalmology-focused ProQR is cutting 30% of its staff, including Chief Scientific Officer Naveed Shams, M.D., Ph.D., as the company re-strategizes following a phase 2/3 setback two months ago.

Stryker: 88 workers have lost their jobs at a facility in Florida as part of rolling layoffs at medtech giant Stryker.

PerkinElmer: As a COVID-19 testing contract winds down with the state of California, PerkinElmer is letting 75 people go effective June 4. The lab services giant is closing down operations at the California Department of Public Health’s laboratory in Valencia, a neighborhood of Los Angeles County.

Kaleido: After a dismal last eight months, microbiome-focused Kaleido Therapeutics is closing up shop and axing the rest of its workforce, including the CEO, CFO and CSO. The update comes a few months after the company trimmed its staff to stave off what increasingly seemed like an inevitable end after numerous ruptures to its pipeline. The company had accumulated a deficit that exceeded $360 million, acccording to its latest annual report.

Akebia: After a partial clinical hold and an FDA rejection, Akebia is cutting 42% of its workforce across “all areas of the company."

Sanofi: The French pharma disclosed in a New York Worker Adjustment and Retraining Notification (WARN) notice dated March 31 (PDF) that 25 workers would be "dislocated" due to a plant closing in the state. The layoffs stem from the $1.9 billion acquisition of Kadmon, which Sanofi closed in November 2021. The filing said that the employees would be cut due to an integration of resources and the business would be permanently closing. The layoffs will begin on July 1 and wrap up by April 1, 2023.

Catalyst Biosciences: The company is at a corporate crossroads, emblematic in the decision to switch up its pipeline and call for strategic alternatives. As a part of the soul-searching, 19 employees or 70% of remaining staff have lost their jobs, according to an earnings report released March 31.

Bluebird bio: A few weeks after its spinout announced layoffs, the same happened at bluebird. Facing several regulatory setbacks, the company is cutting 30% of its workforce.

as the company restructures R&D operations. (Novartis)

Novartis: A major restructuring is underway at Novartis, with several high profile executives caught up in the changes. The cuts will trigger some broader job losses as well, but the company has so far been mum on the details.

March—17 companies total

Taysha Gene Therapies: Pink slips were handed out to about 35% of workers at Taysha in March as the biotech slimmed down its R&D focus.

Zealand Pharma: After a new drug launch went sideways, Zealand had to reduce its workforce by a whopping 90%.

Bone Therapeutics: About a quarter of Bone's workforce was let go in early March as the biotech scrambled to save cash.

BridgeBio Pharma: After a disappointing phase 3 result stunned the company at the end of last year, BridgeBio cut an undisclosed number of employees.

Silverback Therapeutics: A restructuring led to a 27% workforce reduction at Silverback, the biotech said at the end of March. Two clinical oncology programs were also shelved.

Merck & Co.: The company's Acceleron buyout ranked among the biggest deals of 2021, but Merck nevertheless moved to cut about 143 employees from the unit at the end of March.

2seventy bio: The newly- spun out biotech confirmed in late March that about 6% of its workforce would be let go in an effort to reduce overhead costs.

Orion: Another pipeline refocus claimed about 37 employees in late March as the company pivoted to cancer and pain.

Zosano: About 31% of staff was cut from Zosano's bench, according to a March 17 earnings release, as the biotech explored strategic options.

Athenex: In an effort to lower operating costs by 50%, Athenex cut its workforce, although details were slim in the March 16 earnings release.

Ovid Therapeutics: After a rough year, Ovid announced a new focus on its epilepsy- and seizure-related programs in March, saying 20% of staff would be cut in the process.

Passage Bio: The gene therapy biotech trimmed its workforce by 13% and doubled down on a partnership with James Wilson, M.D., Ph.D., and his University of Pennsylvania lab in March.

Orphazyme: Struggling Danish meme stock biotech Orphazyme announced a second round of layoffs in March amid a court-mediated restructuring.

Adaptive Biotechnologies: About 100 workers lost their jobs at Adaptive in March as the biotech trimmed down to focus on minimal residual disease and immune medicine.

Gilead Sciences: Another Big Pharma caught up in the trend, Gilead laid off 114 workers based out of the former Immunomedics headquarters in New Jersey.

Biogen: After a tumultuous nine months marked by a controversial Alzheimer's disease approval and difficult launch for Aduhelm—not to mention several clinical flops—Biogen's restructuring snared an undisclosed number of staffers in March.

Epizyme: Two clinical studies and 12% of staff went out the door at Epizyme when the company reported earnings March 1.

February—5 companies total

Gemini Therapeutics: President and CEO Jason Meyenburg departed Gemini along with 24 employees in late February.

Yumanity: Sixty percent of Yumanity's workforce is expected to leave by April as the neurodegenerative-focused biotech seeks a buyer, the company said in February.

Metacrine: After a NASH failure last year, Metacrine halved its staff and adjusted to focus on inflammatory bowel disease in February.

Biosplice: Once worth $12 billion, Biosplice laid off 41 workers in early February and culled a male pattern baldness drug.

Unity Biotechnology: The anti-aging biotech once again laid off workers in early February, with half of the staff getting the cut. The company also reprioritized to focus on ophthalmology.

January—8 companies total

Gamida Cell: This late January wave of layoffs was cushioned by some good news: Gamida Cell was initiating a rolling FDA submission for the blood cancer treatment omidubicel. But the biotech would need help from strategic partners and a 10% reduction in head count to get the filing across the finish line.

25% within days of taking the job in January. (Zymeworks)

Kaleido Biosciences: Flagship Pioneering-incubated Kaleido shrank its workforce, halted a planned phase 2 trial and terminated an agreement with the COPD Foundation in January.

Zymeworks: New CEO Kenneth Galbraith quickly wielded the ax to reduce headcount by 25% and halve the cancer biotech's C-suite in January, just days after taking over the executive job.

Acutus Medical: A number of employees lost their jobs Jan. 19 when Acutus Medical moved to slash tens of millions of dollars from its annual operating expenses. The company did not disclose the full toll, but said they would be required to file a public disclosure under the Worker Adjustment and Retraining Notification (WARN) Act, which requires 60-day notice before employers lay off at least 50 workers.

Leo Pharma: Leo Pharma announced some major restructuring on Jan. 19 that hit about 68 employees right away. But the reorganization could ultimately affect 1,000 positions over the next two years. The company is shutting down its regenerative medicine innovation hub and science and tech centers in Asia and Boston.

Daiichi Sankyo: Cuts at the Japanese pharmaceutical company announced Jan. 12 impacted about 60 employees. The company shut down its Plexxikon R&D operation in South San Francisco, 10 years after buying the biotech for $805 million upfront.

BeyondSpring: The biotech axed 35% of its U.S. staff on Jan. 12 after the FDA rejected its chemotherapy-induced neutropenia drug called plinabulin.

Spectrum Therapeutics: Spectrum announced a 30% staff cut Jan. 5 in an effort to save cash and focus on mid- and late-stage cancer meds. The move followed an FDA rejection in August 2021.