We've seen plenty of acrimony from the biotech communities in the U.S. and Europe over the insufficient venture capital dollars for young drug developers. But while VC players had a pivotal role in the growth of the biotech sectors in the West, it's not as clear whether they will play a leading part or a small support role in the rise of the industry in key emerging markets such as China and India.

We've seen plenty of acrimony from the biotech communities in the U.S. and Europe over the insufficient venture capital dollars for young drug developers. But while VC players had a pivotal role in the growth of the biotech sectors in the West, it's not as clear whether they will play a leading part or a small support role in the rise of the industry in key emerging markets such as China and India.

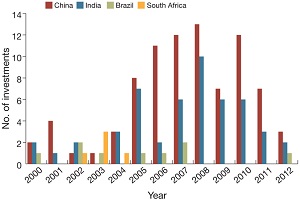

Last week Nature Biotechnology published an article (sub. req.) that shows a special lack of VC funding in certain emerging markets over the past decade or so. Its findings are important because it focuses on venture investments in innovative R&D, culling the deals involving manufacturing and services outfits without drug research operations. From January 2000 to August 2012, the authors found, venture investments in research-based companies in China, India, Brazil and South Africa came in at around $1.6 billion to $1.7 billion (weighted heavily in China and India). To highlight how meager this total is, they noted that VC investors pumped $1.1 billion into U.S. life sciences groups in just three months during the third quarter of 2011.

|

| Click the image to enlarge.--Courtesy of co-author Justin Chakma of Thomas, McNerney & Partners |

It's important to note, as the authors of the article do, that the biotech sectors in China and India have found more fruitful sources of funding than the venture industry. Big Pharma companies, local drugmakers and governments pour about $14 billion annually into R&D in the four countries surveyed, compared to $100 million to $150 million annually from venture backers. In global terms, China gets less than 2% of its biopharma R&D dollars from VC groups compared with worldwide average VC share of national R&D spending of 10%.

Over at In the Pipeline, Derek Lowe provided a perspective on what these data estimates from the Nature Biotechnology article mean for the startup scenes in those markets. And he notes how no amount of money seems to be able to turn hubs in Asia into prime-time biotech clusters on par with Boston and San Francisco.

Here's my question: How will China or India build the next Genentech? South San Francisco-based Genentech, founded in the 1970s, benefited early on from venture investments before there really was an established biotech industry. Based on the numbers from the Nature Biotechnology article, Chinese entrepreneurs might have to build their biotech powerhouse without much help from VC investors.

-- Ryan McBride (email | Twitter)