|

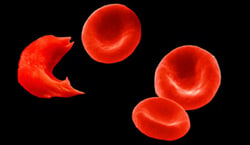

| Courtesy of NHS |

San Francisco's Global Blood Therapeutics, founded by Third Rock Ventures, is angling for a $115 million IPO to bankroll its work on an oral treatment for sickle cell disease.

The company, launched in 2011, is plotting to make its debut on the Nasdaq under the symbol "GBT," for now staying quiet on how many shares it intends to offer or at what price. The proceeds of its planned debut will go toward GBT440, an oral drug designed to interrupt the root cause of sickle cell disease.

Healthy red blood cells become sickled when their hemoglobin fuses together into long, sharp strands, leading to the characteristic cell malformation that can cause deadly blockages in blood vessels. GBT440 works by binding to those hemoglobin molecules before they stick together, encouraging them to oxidize and thereby reducing the chances that they sickle, the company believes.

GBT opened up a Phase I/II study on the drug in December, looking to enroll up to 128 patients both healthy and with sickle cell disease to first establish GBT440's tolerability and then chart how well it can combat the disease. That trial should wrap up in May, according to a listing on ClinicalTrials.gov, after which GBT plans to sit down with regulators and map out a path forward.

Sickle cell disease affects about 100,000 people in the U.S., and GBT figures it costs about $200,000 a year to treat the average patient, working out to more than $8 million over a lifetime. Standard treatment for the disease relies on toxic treatments like hydroxyurea, or inconvenient blood transfusions and bone marrow transplants. That creates a sizable opportunity for any effective oral drug, according to GBT, and the company believes it could tap the market with a small sales force if GBT440 wins eventual approval.

GBT is a graduate of Third Rock's startup academy, through which the company assembles talent around a promising technology and ponies up for early-stage development. GBT got off the ground with a $40 million Series A in 2012 and raised $48 million more in January. Third Rock owns a 63% stake in the company, while Fidelity, which joined its Series B round, holds 13.2%.

Elsewhere in sickle cell disease, bluebird bio ($BLUE), another Third Rock alum, is in the early stages of determining whether its gene therapy can wean patients off of the need for transfusions after a single dose, so far showing promise in results from a single patient.

- read GBT's filing