Despite the potential for declining COVID-19 testing revenues on the horizon, Hologic is upping its revenue forecasts for the year—built in part on the back of the M&A deals it closed last year using its pandemic testing windfalls.

The company said it would begin adding sales from its tuck-in acquisitions to its organic revenue numbers in the months ahead. That includes the cancer test makers Biotheranostics and Diagenode by the end of June and the infectious disease-focused Mobidiag—Hologic’s largest pandemic purchase, at $795 million—by the end of September and the close of the company’s 2022 fiscal calendar.

All told—with slight growth in its core diagnostic and surgery offerings—that should help push Hologic’s annual revenue to between $4.6 billion to $4.7 billion, the company said in its updated financial guidance, which it increased from the projections of $4.4 billion to $4.55 billion it set in the last quarter. But that still leaves a large gap compared to the $5.63 billion in revenues collected during its 2021 fiscal year.

“In this challenging macro environment, the health and diversity of our base businesses plus our diagnostic testing for COVID-19 give us incredible confidence and excitement that we are building a stronger company for the long-term,” Chairman, President and CEO Steve MacMillan said in a statement.

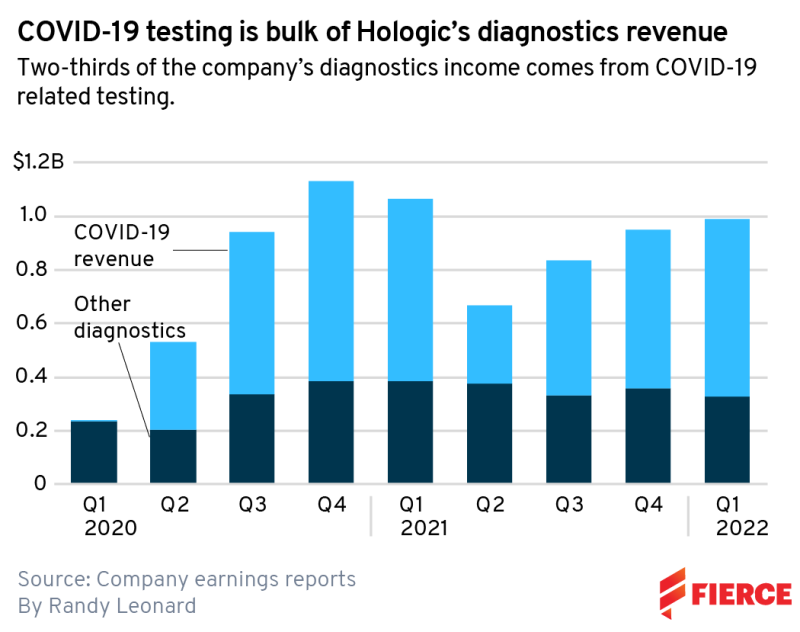

During the first three months of this year, the coronavirus’s omicron surge pushed Hologic to $657.6 million in COVID lab test sales, a sizable increase over the immediate previous quarter but a 13% decrease compared to the same period in 2021.

That accounts for a majority of the company’s total diagnostic haul, which amounted to $987.1 million last quarter, down from the $1.065 billion it saw the year before. Excluding COVID-19 testing entirely, core diagnostics sales grew by 4% on a constant currency basis.

Hologic also logged slim gains of 3.5% in its gynecological surgery business, which came in below previous forecasts as the spread of the omicron variant reduced procedure volumes nationwide.

But the company also saw declines of 6.2% in its skeletal health and 6.8% in its breast health and imaging divisions, with the latter impacted by the lagging global supply chain and shortages of computer chips.

In total, Hologic logged $1.436 billion in revenue for the quarter, a 5.2% drop from 2021, for $455.7 million in net income after expenses.

Following its shopping spree last year, Hologic began a broad European launch last October of a tabletop diagnostic system obtained through its Mobidiag deal. The stackable Novodiag platform uses real-time PCR and microarrays to identify multiple pathogens in a single sample, offering CE-marked assays for a range of infections and measures of antibiotic resistance.

The modular system aims to complement Hologic’s mainstay Panther lines of fully automated, high-throughput analyzers—lab test machines that have driven large profits to the company since the beginning of the pandemic.

However, many companies in the diagnostic industry anticipate COVID-19 sales to dry up over the remainder of this year, as the pandemic takes a turn toward the endemic stage. Earlier this week, Roche said it expects COVID revenues to drop by about $2 billion, while Abbott said it expects to have made the majority of its 2022 sales within just the first quarter of the year.

At the same time, Quest Diagnostics and Labcorp are focusing on growing out their consumer-initiated and at-home testing businesses to pick up the slack going forward.

And as to whether Hologic’s pandemic-era shopping spree will continue? “We're comfortable being patient right now,” CEO MacMillan said on a call with investors.

“Just because we have a very strong amount of cash on the balance sheet doesn't mean we feel pressure to go do it in the next quarter or two,” he said. “We know that deals will present themselves in the quarters or years ahead.”