After its planned $230 million acquisition of Korean stent maker M.I.Tech sputtered out earlier this year, Boston Scientific is making up for it with an even bigger buy.

The medtech giant now plans to shell out $850 million in cash for Relievant Medsystems, the Minnesota-based maker of an ablation system to treat chronic lower back pain. The payout stands to grow even larger if Relievant’s business hits certain sales milestones over the next three years, as Boston Scientific tacked on an undisclosed amount in contingent payments to the deal.

“We anticipate this novel, clinically-backed technology can support our category leadership strategy while expanding access to care for individuals who need personalized treatment,″ Jim Cassidy, president of neuromodulation at Boston Scientific, said in the company’s announcement Tuesday. ″Upon close, we look forward to working with the Relievant team to explore opportunities to bring this high-growth therapy to a wider population of people living with chronic low back pain.″

The deal is expected to be made official occur sometime in the first half of next year, per the release.

Relievant was founded nearly two decades ago to build out the nerve ablation technology that would ultimately become the Intracept system.

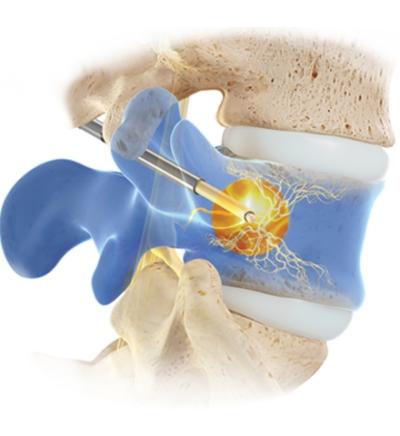

As with other ablation systems—including the many already found in Boston Scientific’s portfolio—during an Intracept procedure, a catheter is inserted via a minimally invasive procedure to emit targeted radiofrequency energy, essentially burning out away any abnormal activity within the body. In the case of the Intracept system, the catheter is aimed at the basivertebral nerve, with an aim of stopping the nerve from sending pain signals to the brain.

The technology earned FDA clearance in 2016 and remains the only system greenlit specifically to treat vertebrogenic pain—a specific form of chronic low back pain that’s caused by damage to the vertebral endplates and affects more than 5 million people in the U.S. alone, according to data cited by Boston Scientific.

The company is acquiring the system and its maker amid a period of significant growth for Relievant: It’s on track to rake in sales of more than $70 million this year, then to grow that by more than 50% in 2024, by which time it should be under Boston Scientific’s purview, if all goes according to plan.

The buyer said in Tuesday’s release that it expects the purchase to be immaterial to its 2024 earnings, “slightly accretive” the following year and then “increasingly accretive” from 2026 on.

The proposed Relievant buyout marks Boston Scientific’s first M&A move since it backed out of a previously planned purchase of M.I.Tech. In a late May statement, the company attributed the deal’s fizzling to “required global regulatory approvals that we were not able to obtain in some countries.”

In its place, rather than doling out about $234 million to acquire a majority stake in M.I.Tech, Boston Scientific signed a new agreement to acquire a share of about 9.9% in the devicemaker.