|

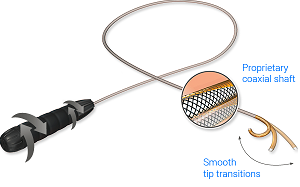

| The Vado steerable sheath--Courtesy of Kalila Medical |

Abbott ($ABT) once again added to its electrophysiology offerings via acquisition. It just announced the purchase of Kalila Medical, maker of an FDA-cleared steerable sheath for navigation during cardiac ablation procedures, for an undisclosed sum.

The company in 2014 dove headfirst into the interventional market to treat atrial fibrillation by destroying tissue, making three simultaneous deals, including the acquisition of Topera for $250 million. It also acquired a (so far unused) option to acquire Advanced Catheter Therapeutics and participated in a venture round for VytronUS. All three companies were backed by the NEA.

The latest deal gives Abbott access to a device for introducing its electrophysiology catheters into the vasculature and chambers of the heart. Kalila's Vado Steerable Sheath includes a hemostasis valve to minimize blood loss, side port for fluid infusion, blood sampling and pressure monitoring, and radiopaque markers to facilitate visualization under fluoroscopy, the FDA says in its 510(k) letter.

The innovative design "eliminates whipping from torque buildup experienced with other sheath designs" and may decrease procedure times, Abbott said in a release.

"Atrial fibrillation is a serious condition that increases the risk of stroke and causes severe symptoms in many patients, but remains undertreated today because current technologies have limited effectiveness," said Michael Pederson, the general manager of Abbott's electrophysiology business, in a statement. "With this acquisition, Abbott gains a unique technology to expand our portfolio of tools for the treatment of atrial fibrillation and other heart rhythm disorders. We look forward to initiating the launch of this innovative sheath in the United States and Europe in the coming weeks."

The acquisition of the Campbell, CA-based company demonstrates the demand for startups with technologies that enhance, or are adjacent or complementary to, devices currently sold by bigwigs (electrophysiology catheters in the case of Abbott). It also shows that they are willing to pay a premium up front for exclusive access to technologies that improve their central offering.

Medtronic's ($MDT) purchase of stent retriever cover maker comes Lazarus Effect to mind. The Irish start-up earned a $100 million exit because it had a novel nitinol mesh that should improve the performance of Medtronic's Solitaire device to treat stroke.

And Stryker ($SYK) will benefit from the recurring revenue provided by devices made by Sage Products, to be acquired for $2.8 billion. The bigwig will leverage its platform devices to sell Sage's related offerings faster, such as the Prevalon Turn and Position System to prevent bed sores, which can be sold alongside Stryker's hospital beds.

- read the release