You're not going to hear a private biotech trumpeting a down round as they announce a new batch of funding, but industry experts say the broader market trend has seeped into the sector, while financings as a whole fell 24% last year.

That's because a down round used to ring red-hot alarm bells. But as valuations change, investors say the meaning of a down round might, too.

The term is used to refer to a financing round raised by a company that is offered at a lower share price compared to a previous round or time period. Typically, a company's valuation is expected to rise with each subsequent financing. But in business, anything can happen—like a historic global pandemic, for example.

In the second quarter of this year, the proportion of down private financing rounds across all sectors hit its highest peak in seven years, according to data collected by industry law firm Cooley. The firm reported that 21% of all the venture financing rounds it handled for the quarter were down, the most in any quarter since the second quarter of 2016. Meanwhile, flat rounds represented just 2% of deals during the quarter, down from 11% in the first quarter and aligning with numbers seen during 2021 and early 2022.

While not specific to biotech, the report highlights an important trend that Cooley Partner Josh Seidenfeld doesn’t think is going away anytime soon. Seidenfeld is also Cooley’s global chair of digital health and has handled more than 350 venture capital financings with an aggregate deal value of more than $5 billion over the past five years, including Cellares’ $255 million series C this year. He told Fierce Biotech that he thinks down rounds are a trend that could be settling in as just a part of the venture community.

While it’s difficult to pin down biotech-specific valuation data, the overall trend shows a massive drop in financings.

After two record-setting years, private biotech financings fell 24% from the highs of 2021. In total, private biotech investors put down $21.7 billion in 2022, compared to 2021's $28.5 billion, according to Evaluate Vantage.

“Valuations—in my judgment—were way ahead of themselves.” — Les Funtleyder, E Squared Capital Management

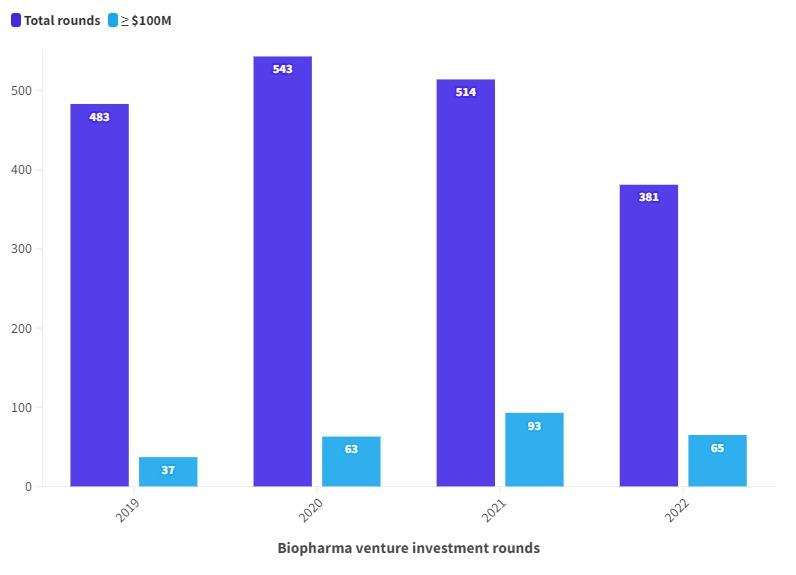

The number of fundraises also dropped 25%, with 381 rounds last year versus 514 in 2021. Only 65 rounds equaled or eclipsed $100 million in 2022, compared to 93 in 2021, but still rising above 2020’s 63.

After so much money was thrown into the industry, conditions deteriorated, creating poor prospects for going public, sparse M&A activity and a pullback in venture capital investment followed by mass layoffs—all impacts that are still being felt today.

“My initial thought is it's a return to reality,” Les Funtleyder, healthcare portfolio manager at E Squared Capital Management, told Fierce Biotech. “Valuations—in my judgment—were way ahead of themselves.”

Funtleyder called the biotech investing highs of the pandemic a “once-in-a-decade bubble” and said returning to normal after living through such a time can feel like a letdown.

“It's sort of the hangover, which is why you get down rounds,” said Funtleyder, who authored "Healthcare Investing: Profiting from the New World of Pharma, Biotech, and Health Care Services" and previously served as the chief financial officer for Applied Therapeutics.

Lindy Fishburne, founder and managing partner of early-stage fund Breakout Ventures, said prices are just settling back down.

“If you really look at the macro-economic view over the last five years, the pricing that occurred was the anomaly,” Fishburne said. “And now we're coming back to or reverting to the mean.”

Losing the stigma

In a normal market, a down round occurs because a company doesn't hit milestones they were expected to hit—a big, bright red flag. But in a down market, the signal isn’t the same.

Instead, a down round can become a commentary on the broader environment instead of the individual company, Cooley’s Seidenfeld said, adding that even biotechs with great data and strong leaders aren’t necessarily able to raise financing on “premium” terms in this market. Ultimately, companies with strong science may end up raising a flat round—where the company's valuation stays the same as the round before—or a modest down round.

“When the market has those adjustments occurring across the board, it does lose some of that stigma associated with it,” Seidenfeld said.

In the current environment, a strong company raising a flat or down round isn't reflective of a company's quality, according to Fishburne.

“You have a lot of very capable, very well run, really interesting companies that are building platforms and technologies of great value,” she explained. “And they're being repriced right now, which is just a different context than ‘You kind of blew it.’”

Another trend is a rise in financing extensions, where a biotech snags some additional cash using the same terms as a previous round. ReCode Therapeutics just brought its series B total to $260 million and snagged some new investors this way. The $80 million round originally went down in 2021, followed by an extension of $120 million in summer of 2022, and now another $50 million has been tacked on.

Rome Therapeutics did the same, adding $72 million and Big Pharma investors Johnson & Johnson and Bristol Myers Squibb, bringing the biotech's series B haul to $149 million total.

Novo Holdings Senior Partner Naveed Siddiqi told Fierce Biotech: “We’re seeing a lot of extensions of existing rounds, where basically you get one new investor to come in at the price the last round was done as a flat on the same terms."

Because of the selective nature of deals occurring right now, Cooley’s Seidenfeld said companies may have to reach higher standards than before. As for investors, well, they can basically “name their price.”

“When dollars are abundant, things can get sloppier. So, as an investor, this is an incredible market to be investing in,” Fishburne said.

When considering investing, Breakout Ventures wants to know where a company will fit into the market. The firm wants to see what a company plans to do with its money, what its milestones are, what technical and scientific derisking measures are being taken and what market validation the company expects to achieve with those dollars.

Fishburne also looks at what a company pledged to do with its capital versus what actually happened with the money. While she acknowledged that there are bumps along the way and things don’t always go as planned, Fishburne said it’s important to assess how close a company was to its goals.

Company leaders should also show that they’re aware of the market they're in and address how they will run their business differently in a market of capital scarcity. Biotechs would be wise not to get hung up on current valuations and instead accept the anomalous price of the past, adjust to the current market conditions and get back to work, Fishburne advised.

A crescendo

The biopharma world—or creative biosciences as Fishburne calls it—has an advantage over many other industries trying to raise capital. The nature of the sector gives companies the ability to leverage non-dilutive grants, she explained. Non-dilutive financing is funding that doesn’t require giving up equity or ownership, such as government and research grants.

Ideally, companies build up their capital stack over time with both non-dilutive grants and investing dollars to help cushion market blows, the Breakout Ventures founder recommended.

While Cooley’s Seidenfeld hasn’t yet seen the overall numbers for the third quarter, he suspects the trends will be consistent with the second quarter, with very high deal selectivity and deals taking longer to get done.

“I don't think we're getting away from the current environment that we're in anytime soon,” Seidenfeld said.

“In my experience, bear markets don't necessarily end in a crescendo,” E Squared’s Funtleyder said, speculating on the eventual end of the prolonged down market. “They sort of seem to end in indifference, like when nobody cares anymore.”

Despite the challenging economic conditions, the science, technology and innovation investors are seeing is the strongest it's ever been, according to Fishburne, adding that she hopes to see more efficient raises happening toward the end of this year.

Funtleyder agrees, highlighting the cardiometabolic, rare diseases and neuropsychiatry spaces as specific innovative pockets fostering lots of excitement.

“It’s not all gloom and doom,” Funtleyder said. “Under the surface, things are percolating.”