Daiichi Sankyo, coming off a successful trip to Madrid that included a megadeal and a data drop to set the record straight on its next ADC candidate’s safety, is setting up for a lucrative few years.

In its fiscal year 2023 second-quarter earnings release on Tuesday, the Japanese biopharma detailed the terms of its megadeal with Merck & Co., which includes $4.5 billion in possible upfront payments and up to $22 billion overall.

Daiichi has increased its revenue forecast (PDF) for 2024 by 100 billion Japanese yen ($662.4 million) to reach 1.55 billion Japanese yen ($10.27 billion), attributed to the Merck deal, Enhertu revenue and foreign exchange.

It’s a massive deal that became the talk of the European Society for Medical Oncology conference in Madrid, which ran Oct. 20 to 24. Merck snagged rights to three antibody-drug conjugates: HER3-DXd, I-DXd (DS‐7300), R-DXd (DS-6000). Daiichi has already had huge success with Enhertu through a partnership with AstraZeneca. The partners are also working on he TROP2-directed candidate datopotamab deruxtecan (Dato-DXd), which was showcased at ESMO.

Daiichi said the new deal will “maximize the value” of the three candidates by accelerating and expanding development.

But it will also allow Daiichi to flip some cash towards its earlier stage pipeline, including growth drivers 5DXd-ADCs, post DXd-ADC modalities and others, according to the earnings presentation.

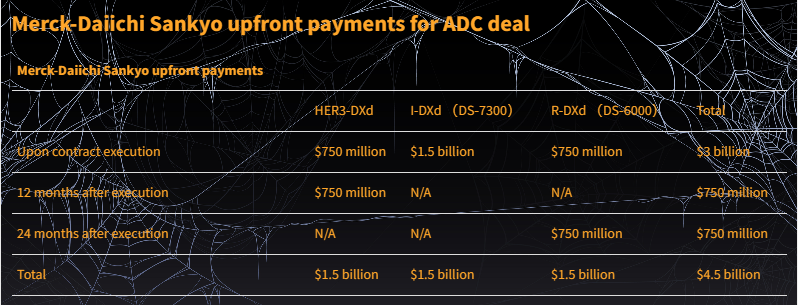

Near term, Daiichi will receive $3 billion upfront from Merck, with I-DXd garnering the most with a $1.5 billion payment and $750 million each for the other two. Daiichi will defer the payments and book them as revenue. While the total value of the upfronts is $4.5 billion, Merck will need to opt into all three candidates for Daiichi to receive the entire amount.

Still, it’s a windfall for Daiichi, which evidently spoke to quite a few pharmas before landing on Merck. Daiichi’s Mark Rutstein, M.D., head of global oncology clinical development, told Fierce Biotech on the sidelines of ESMO that Merck was the right partner given its clinical history with Keytruda.

But AbbVie’s CEO Rich Gonzalez revealed last week that his company was aware of the possibility to work with the Japanese biopharma. “We knew it was there,” Gonzalez told investors during a third-quarter earnings call.

Merck and Daiichi will share research expenses for the three programs, with the former paying 75% of costs of the first $2 billion in R&D expenses for each product. After that, the companies will equally share the expenses. Certain portions of the R&D expenses for HER3-DXd and I-DXd will be paid upon contract execution but may be refundable if the programs are terminated early. R-DXd will be paid as R&D expenses are incurred.

If the products succeed, Daiichi could see sales milestones up to $16.5 billion, or $5.5 billion per product. These sales will be booked as revenue in the year of achievement.

Daiichi will host an R&D day on Dec. 11.

Gabrielle Masson contributed to this story.