It’s the time of year when the Fierce Biotech team sticks its shovel into fresh soil to bury another year’s worth of biotechs. Though the list is ritualistic, it’s hardly ceremonious. It marks the difficult decision many drug developers had to make after funds ran dry or scientific leads reached dead ends or both. And, in the industry’s current financing environment, an exorbitant amount of biotechs have reached this point.

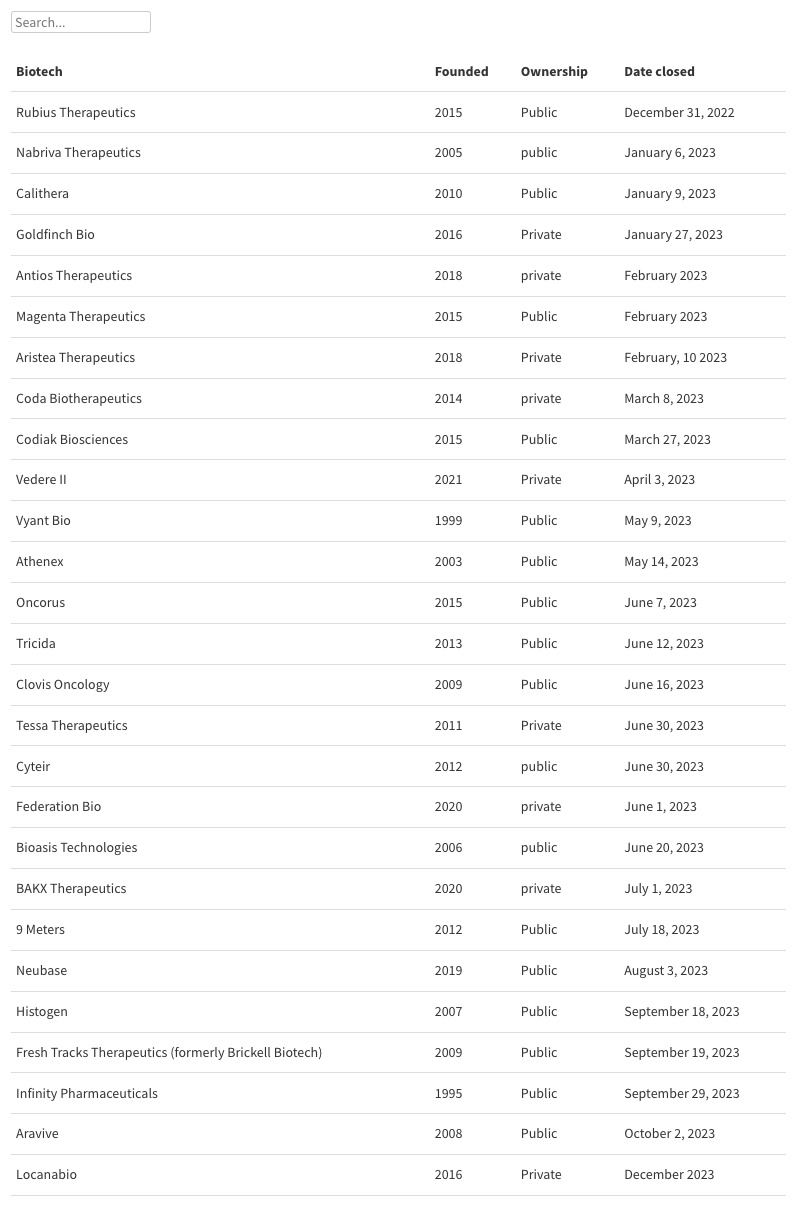

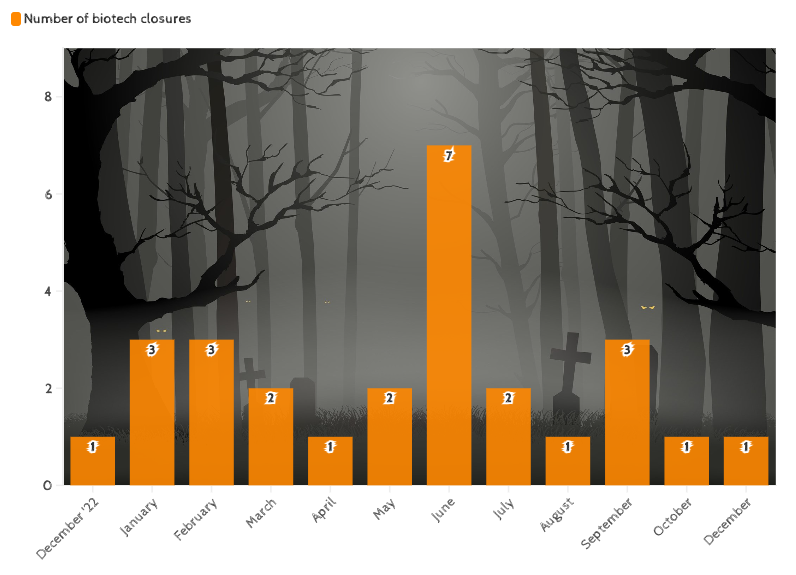

All told, we tallied 27 biotechs that shuttered this year or disclosed plans to do so, nearly four times as many as last year's seven companies. Maybe it’s the chickens coming home to roost after private financing remained relatively bullish in 2022 despite the dampening public marketplace or, rather, executives being quicker to pull the plug. Regardless, the number of biotechs calling it quits reiterates just how difficult it can be to achieve and maintain success.

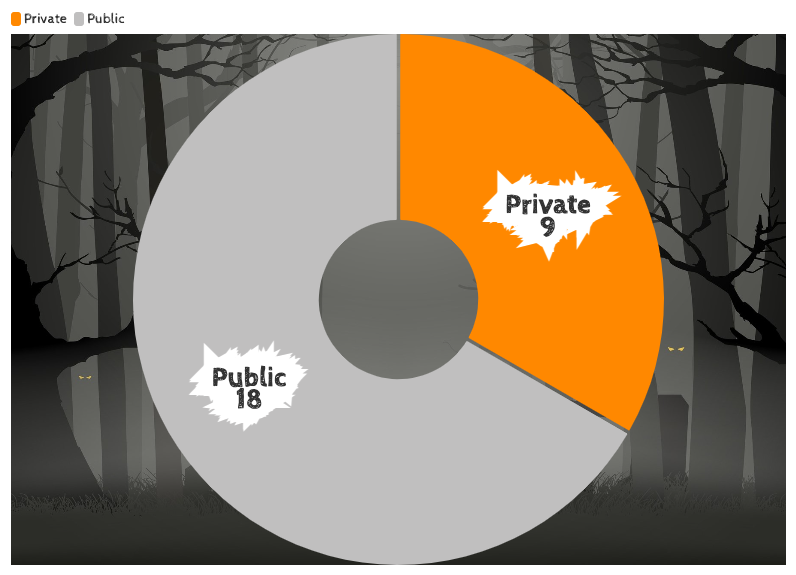

There wasn’t a consistent theme among the biotechs that landed in the graveyard this year, with biotechs spanning disease areas, modalities and whether they were private or public. Some went out with a bang, others with a whimper.

Take Antios Therapeutics as an example. The biotech raised more than $170 million from a series B in 2021 but closed its doors in February after waving the white flag, with the company’s chief medical officer citing an insurmountable FDA hold when probed by Fierce Biotech. The company’s closure did not come to light until September. Tessa Therapeutics, once considered one of the most promising biotechs out of Singapore, similarly closed suddenly.

For others, the writing was on the wall for months. Flagship’s Rubius Therapeutics dumped its two lead assets in September 2022 after getting a glimpse at early data, saying additional work was no longer justified. The biotech pivoted to a revised cell conjugation platform, albeit with a fraction of the staff that helped build the company. So much for that, with the ambitious reorganization lasting less than six months before the company formally dissolved.

It’s important to note that there’s some subjectivity to this list. For our purposes, we included any and all biotechs that either dissolved, closed down or seemed to unequivocally communicate a shutdown so far in 2023. Many companies on this list marked their closure by filing for bankruptcy, but we understand that doesn’t inherently mean that a closure is imminent.

Sorrento Therapeutics is an example of a company that filed for bankruptcy earlier this year but was left off this list due to pending litigation and efforts to secure additional financing through a variety of means. It just wasn’t clear-cut that the company was, in fact, closing.

With the number of biotechs in this year’s graveyard ballooning so much, we’re reformatting the report. Gone are the quick individual eulogies and in are data visualizations that dive a bit further into trends behind these closures. As always, if we missed a company on this list, let us know!

More than 1 in 4 closures occurred in June, according to our reporting and additional disclosures. Included in the group was Cyteir, which announced it would be dissolving after lead cancer med CYT-0851 failed to impress. The asset was being aimed at a number of solid tumors, and, while Cytier was observing durable responses, it couldn't afford to pour more money into development.

Bioasis, another June closure, had a different trajectory. The company's exit hatch slammed shut in January when a merger with Medatech fell through. Potential milestone payment revenue also evaporated after a 2020 partnership with Chiesi was canceled. That left creditors to close in on $4 million in loans, forcing the company's hand.

The December 2023 closure is Locanabio, after CEO Jim Burns confirmed to Fierce Biotech that the company plans to cease operations by the end of the year.

Roughly two-thirds of the biotechs in our graveyard tally were public, indicative of the frosty public markets that left drug developers with few options.

For Magenta Therapeutics, the closure was spurred by a patient death in a trial testing its leukemia treatment. NeuBase, on the other hand, halted further development before any of its assets even entered the clinic.

As for the private biotechs, a number of them faded away quietly. Goldfinch Bio abruptly filed for bankruptcy in late January after failing to secure additional financing, and Vedere Bio II closed in April when preclinical data indicated it wouldn't replicate the success of the first Vedere, which was acquired by Novartis.

Editor's note: This story was updated on November 5 to include five additional biotechs: Clovis Oncology, Vyant Bio, Locanabio, Codiak Biosciences and Tricida. All graphics by Gabrielle Masson, with data compiled by Fierce Biotech.