Last year ended on a high note in the venture capital arena, with $1.3 billion injected into the biotech industry in the final three months of the year. That's a solid record, accounting for a slight surge over the $1.25 billion in venture investing tracked in the previous quarter. But the strong finish in the second half of the year was still well off the pace set in 2011 and couldn't make up for all the sour notes that came earlier in 2012.

Last year ended on a high note in the venture capital arena, with $1.3 billion injected into the biotech industry in the final three months of the year. That's a solid record, accounting for a slight surge over the $1.25 billion in venture investing tracked in the previous quarter. But the strong finish in the second half of the year was still well off the pace set in 2011 and couldn't make up for all the sour notes that came earlier in 2012.

The MoneyTree report--a collaboration involving the National Venture Capital Association and PricewaterhouseCoopers with data provided from Thomson Reuters--concluded that $4.1 billion was invested in biotech last year, well short of the $4.9 billion that was pumped into developers in 2011 and just slightly above the $3.9 billion invested in 2010. The biotech industry was hit with an anemic second quarter in 2012 that highlighted a generally constrained environment for new venture investing, with a particularly painful track record on first-time financings throughout the year.

The biotech and medical device industries combined collected 25% of the VC cash invested last year, in line with 2011.

|

| Here's a list of the top 15 deals in 2012. |

The bump in second-half activity had a lot to do with the top deals in the pack, with fewer biotechs attracting the lion's share of the cash, says Tracy Lefteroff, PwC's longtime life sciences consultant. And that fits into an overall trend expected to play out in 2013, as most venture players continue to focus on later-stage deals largely reserved for a pack of seasoned entrepreneurs.

"Long runways to successful exits are only getting longer," NVCA President Mark Heesen told analysts, adding that first-time financings in the life sciences are scraping along the lowest rate of new deals since 1995. Factor in 5 straight years in which life science VCs raised less than they invested, he adds, and it's "likely we'll see fewer and fewer dollars invested in 2013."

Not that Sofinnova Ventures' Jim Healy, a general partner, is bummed out by that prospect. In fact, he rather likes the lay of the land in biotech right now, calling the overall outlook "terrific." Sure, some venture firms are struggling to raise cash from investors, he says, and it's harder for many startups to raise money as well. But when you step back from the micro trouble, a healthier overall picture emerges.

"We do see that macro trends are very positive," says Healy. The healthcare market--and specifically the biopharmaceutical market--is stable. There's a growing number of older people in the country in need of ongoing care. The FDA has presided over a rising tide of approvals, which jumped from an annual rate of just over 20 to close to 40 over the past three years. And each new approval marks a new product that can inspire new businesses, push fresh IPOs and generally support the industry's growth.

Healy operates along with his colleagues according to the Rule of Threes: Invest in Phase III drugs and target a 3x return in three years. That's why he's particularly bullish on orphan drugs, ophthalmology and dermatology. With an orphan drug, for example, it's possible to short circuit the development process with fast track status, with dermatology and ophthalmology looking equally appealing on development cycles.

Healy says 2013 should also be a "terrific" time to invest, provided you factor in some realities: Fundamentals will remain strong, larger pools of capital will be controlled by fewer VCs, fewer companies will get backing but high-quality companies can thrive, with the best being well capitalized for the work they are doing.

That may not be an ideal outline, but the picture he paints is a long way from grim.

To give you a better idea of just what Healy means by the best, we gathered a list of the top 15 biotech investments in 2012. You'll note that many of these figures are smaller than the rounds that were reported last year, as the score keepers focus on the actual cash that flowed to biotechs rather than the tranched rounds that were announced. -- John Carroll, Editor-in-Chief. Follow me on Twitter and LinkedIn.

Top 15 biotech VC deals in 2012

|

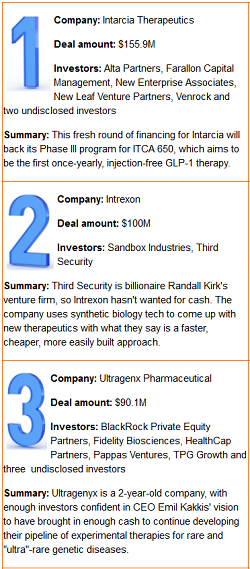

Deal amount: $155.9M Investors: Alta Partners, Farallon Capital Management, New Enterprise Associates, New Leaf Venture Partners, Venrock and two undisclosed investors Summary: This fresh round of financing for Intarcia will back its Phase III program for ITCA 650, which aims to be the first once-yearly, injection-free GLP-1 therapy. |

|

|

Deal amount: $100M Investors: Sandbox Industries, Third Security Summary: Third Security is billionaire Randall Kirk's venture firm, so Intrexon hasn't wanted for cash. The company uses synthetic biology tech to come up with new therapeutics with what they say is a faster, cheaper, more easily built approach. |

|

|

Deal amount: $90.1M Investors: BlackRock Private Equity Partners, Fidelity Biosciences, HealthCap Partners, Pappas Ventures, TPG Growth and three undisclosed investors Summary: Ultragenyx is a 2-year-old company, with enough investors confident in CEO Emil Kakkis' vision to have brought in enough cash to continue developing their pipeline of experimental therapies for rare and "ultra"-rare genetic diseases. |

|

|

Deal amount: $87.8M Investors: Aisling Capital, Column Group, OrbiMed Advisors, Topspin Partners, venBio Partners and one undisclosed investor Summary: Aragon's top candidate in its pipeline is ARN-509, an anti-androgen therapy to treat prostate cancer--a blockbuster market. Aragon was named a Fierce 15 company in 2012. |

|

|

Deal amount: $65M Investors: 5AM Ventures, Delphi Ventures, Mediphase Venture Partners, New Leaf Venture Partners, OrbiMed Advisors, Sibling Capital, Sprout Group Summary: Relypsa's lead candidate is RLY5016, a treatment for hyperkalemia, a condition in which high levels of potassium threaten patients suffering from diabetes, heart failure and kidney disease with a potentially lethal case of arrhythmia. |

|

|

Deal amount: $60M Investors: ARCH Venture Partners, Forbion Capital Partners, RA Capital Management, Third Rock Ventures, TVM Capital GmbH and two undisclosed investors Summary: Genetix, now bluebird bio, is one of the better funded biotechs in early-stage development. Bluebird is a Third Rock creation and has already scored proof-of-concept data for adrenoleukodystrophy, or ALD. |

|

|

Deal amount: $58.3M Investors: InterWest Partners, Kleiner Perkins Caufield & Byers, New Enterprise Associates, Pappas Ventures, T. Rowe Price Threshold Partnerships and one undisclosed investor Summary: Tesaro has in-licensed a pipeline of drugs to treat cancer patients, and the main attraction in its pipeline right now is rolapitant, which is in Phase III development for preventing nausea and vomiting in cancer patients on chemotherapy. The company expects to report top-line data from the program this year. |

|

|

Deal amount: $56.5M Investors: Clarus Ventures and an undisclosed investor Summary: SFJ has been focusing on deals for the clinical development of Big Pharma drugs specifically for Asian markets, a model that attracted the attention of Clarus. SFJ is currently partnered on a lung cancer drug with Pfizer and a thyroid cancer drug with Eisai. |

|

|

Deal amount: $52.19M Investors: Enterprise Partners Venture Capital, GBS Venture Partners Pty., H & Q Healthcare Investors, Hambrecht & Quist Capital Management (H&Q), Johnson & Johnson ($JNJ) Summary: Celladon had the third-highest round in the first of 2012, in which three Big Pharma companies participated--Novartis ($NVS), Pfizer ($PFE) and Johnson & Johnson. The main attraction is Mydicar, an experimental gene therapy in mid-phase trials to treat patients suffering from heart failure. |

|

|

Deal amount: $51M Investors: Aurora Funds, Baxter Ventures, Domain Associates, Edmond de Rothschild Investment Partners SAS, OAO "Rusnano," Quaker Partners Management, Valence Life Sciences Summary: Regado needs the fuel for the pricey Phase III trial of its lead program, REG1, which uses two agents--pegnivacogin and anivamersen--to control bleeding during a coronary intervention and open heart surgery. |

|

|

Deal amount: $50.74M Investor: Undisclosed investor Summary: Sangart's total funding raised is now more than $280 million, all of which is fuel for the company's pipeline of drugs that deliver "essential gases to embattled tissues." The biotech's MP4OX, in a mid-stage trial, is designed to treat tissues threatened with ischemia after hemorrhagic shock. |

|

|

Deal amount: $50M Investor: Undisclosed investor Summary: Onconova has a full slate of mid- and late-stage studies under way on the experimental drug regosertib, a multikinase inhibitor targeting mitotic and PI-3 kinase pathways. This month the biotech announced a partnership with CRO GVK Biosciences. |

|

|

Deal amount: $48.7M Investors: F. Hoffmann-La Roche AG, Google Ventures, Kleiner Perkins Caufield & Byers, Third Rock Ventures and three undisclosed investors Summary: The day after FierceBiotech named Foundation Medicine a Fierce 15 company, the biotech unveiled a new round, which will back commercialization work on FoundationOne, its diagnostic test on the market to evaluate solid tumors. In November, Foundation inked its ninth deal on cancer genomics, this time with AstraZeneca ($AZN). |

|

|

Deal amount: $42.17M Investors: Cycad Group, General Catalyst Partners, Hunt BioVentures, Longwood Founders Management, RA Capital Management and one undisclosed investor Summary: OvaScience is working on stem cell technology for new fertility treatments. The biotech believes that it can significantly improve the success rate for in vitro fertilization by taking mitochondria from a woman's ovarian stem cells and inserting them, along with sperm, into eggs. In August, the company revealed plans to go public. |

|

|

Deal amount: $40.7M Investors: Third Rock Ventures and an undisclosed investor Summary: Third Rock launched the San Francisco-based startup, which is planning to develop a pipeline of oral drugs, with the lead program targeting sickle cell disease. Third Rock partner Mark Goldsmith took the helm at the new company. |

|

Company: Intarcia Therapeutics

Company: Intarcia Therapeutics

Company: Intrexon

Company: Intrexon

Company: Ultragenx Pharmaceutical

Company: Ultragenx Pharmaceutical

Company: Aragon Pharmaceuticals

Company: Aragon Pharmaceuticals

Company: Relypsa

Company: Relypsa

Company: Genetix Pharmaceuticals (now bluebird bio)

Company: Genetix Pharmaceuticals (now bluebird bio)

Company: Tesaro

Company: Tesaro

Company: SFJ Pharmaceuticals

Company: SFJ Pharmaceuticals

Company: Celladon

Company: Celladon

Company: Regado Biosciences

Company: Regado Biosciences

Company: Sangart

Company: Sangart

Company: Onconova Therapeutics

Company: Onconova Therapeutics

Company: Foundation Medicine

Company: Foundation Medicine

Company: OvaScience

Company: OvaScience

Company: Global Blood Therapeutics

Company: Global Blood Therapeutics