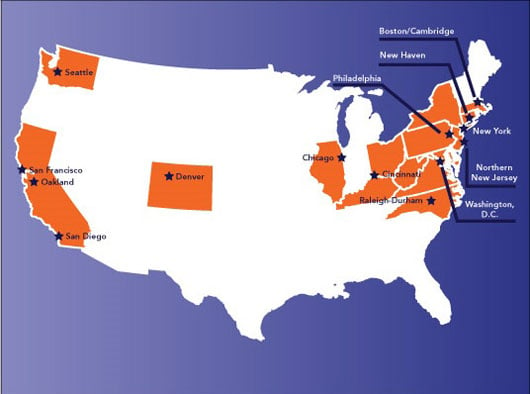

Anyone looking to start a biotech company should pay close attention to this list. Venture groups, entrepreneurs and increasingly Big Pharma have been concentrating their money and their attention in a few key places, only occasionally straying from the beaten path when funding a high-risk drug development effort.

So it's no surprise that San Francisco and Boston should vie for top spot on the list of deals and dollars for 2013, as assembled by the National Venture Capital Association (NVCA), with data assembled by Thomson Reuters. San Diego comes in a distant third, with Washington, DC, and Oakland--perhaps better fitted into the Bay Area roster--coming in fourth and fifth. The top three cities accounted for more than half of all biotech venture cash gambled last year in the U.S., according to the NVCA's figures.

By the time we get into the second tier--Seattle, New York, Philadelphia, a New Jersey hot spot and then down into North Carolina--the cash pales in comparison to the top group. And for the next 5--Cincinnati, OH; Denver, CO; New Haven, CT; LA; and Chicago--the numbers become mere fractions of the year's healthy $4.5 billion total. With a $45 million take, LA would account for only 1% of the total.

Money has a habit of staying close to home. While a team of investigators can run a virtual biotech in rural Alabama, the venture players who put up the cash may not be all that excited about making regular meetings in the same spot. Third Rock, where the general partners got started in Boston, dispatched a leader to open up a San Francisco office, on the ground. When they decide to work with scientists in, say, Florida, the home office of the company they incubate is likely to be in the Boston area. Read more >>

Click on the city names in this chart to read more on each of the top 15.

The fact that San Francisco came out on top in 2013, following two years dominated by the booming biotech hub in the Boston/Cambridge area, is raising a few eyebrows.

"That surprised me," says Mike Powell, a general partner at Sofinnova Ventures in its Menlo Park, CA, office, a city a good number of the nation's venture capitalists call home. Boston has attracted a growing amount of attention from Sofinnova, as well as most other venture groups. And figures from the NVCA support that lead role, with Boston leading San Francisco in 2011 and 2012. But an underlying trend may have caught up with the Boston scene last year, says Powell.

"My perception is that a lot of the Boston-based startups are bigger science, smaller dollars," says Powell. "If you take out a few key deals, the $40 million Series A's, you have smaller deals at an earlier stage."

But even if it is focused on later-stage work, San Francisco also may not stay in the lead position in 2014. For Powell, Boston and San Francisco both have the fully fleshed-out biotech infrastructure the industry needs to perform at maximum efficiency. As an example: If you need an attorney for a 10 p.m. meeting, you can get one. The technology is right there, the experts in every field are there, and the money is there. And Boston may have the edge over the Bay Area.

"I'm of the mind that Boston is coming into its own," says Powell. "I'm spending more and more time in Boston."

For the top hubs, there's a perfect storm of positive influences. You have companies like Sanofi ($SNY), Novartis ($NVS), Pfizer ($PFE) and others crowding into Boston so they can mix it up with startups and local academics in coming up with new programs and deals. And the local venture community is doing everything it can to help accelerate the process with the grease that a money-burning business like biotech demands.

For another illustration of how this dynamic plays out in the states, check out San Diego, where Avalon Ventures is ramping up a group of 10 biotechs with money and help from GlaxoSmithKline ($GSK), which is opening its own local R&D office there as a result. Add in some top-level academic work nearby, and you have the essential ingredients for the further development of a hub.

That lesson has not been lost on New York, where city officials plan to spur the long-awaited growth of a hub by bringing some key players together to build a venture fund to launch startups, with Big Pharma companies playing leading roles. And Manhattan is already home to some of the world's top academics.

Note to economic development groups: Tax incentives and job subsidies help, but nothing is as essential as local venture cash and potential collaborators when it comes to building hubs.

In a recent column, I talked about the geography of money in Europe, where entrepreneurs and academics often find themselves starved of capital. To my way of thinking, that situation has created some distinct advantages for the active buyers in this market, who may be looking for bargains wherever they can find them. The U.S. may have the lion's share of the venture cash and a booming IPO market to look to--for now--but rising valuations in the U.S. do tend to make some of these biotechs far from the madding crowd look more appealing to the acquirers. And the same philosophy could help American biotechs far from the corridors of biotech cash. -- John Carroll, editor-in-chief (email | Twitter)

1. San Francisco

$1.15 billion

Every new year in biotech begins with the big J.P. Morgan conference in San Francisco, so perhaps it's only natural that the biggest annual confab on deals should take place in the city with the largest annual influx of VC dollars last year. South San Francisco is home to the birthplace of biotechnology. Genentech, which rivaled Amgen ($AMGN) as the world's biggest biotech, was acquired by Roche ($RHHBY). But rather than try to simply loot assets, Roche carefully preserved its culture of innovation, being rewarded with a string of new drug approvals for cutting-edge therapies. Just last year another prominent biotech success story in South San Francisco, Onyx, was also bought out, snapped up by new management at Amgen. And Amgen also promised to leave much of the operations intact. It's only natural that the area should be a breeding ground for cutting-edge startups. The influx of VC cash has helped launch some notable companies. In our last Fierce 15 we singled out CytomX, backed by Third Rock, Roche Ventures and Canaan; the fast-growing rare disease player Ultragenyx, backed by founding investors TPG Biotech, Fidelity Biosciences, HealthCap and Pappas Ventures; and the anemia specialists at FibroGen, which also wooed in a number of investors. The University of California, San Francisco--number two on the top 10 research institutions list with a bit more than a half-billion dollars in NIH funding last year--is a hotbed of R&D activity, most recently inking a collaboration with MedImmune. J&J Innovation, meanwhile, opened one of four global partnering offices in San Francisco, soon to be followed by Merck ($MRK). -- JC Back to top | Back to chart

2. Boston/Cambridge

$933.59 million

Just about every time you talk about venture capital in biotech, the conversation turns to greater Boston. It's the one place all the Big Pharma companies believe they need to be, in part because of the whole Harvard/MIT complex in Cambridge. Third Rock sprung up there, pumping money into startups of its own design. Flagship Ventures has called Cambridge home for close to 14 years. So has Atlas Venture, which unfortunately doesn't always like to discuss the early-stage companies it's spawning. Polaris Partners is based in Waltham. And the list goes on. The point is, if you're a well-connected scientist like MIT's Robert Langer and Ram Sasisekharan, there's money available and a talent pool of biotech vets waiting to take something to the clinic. It also helps that after taking the biotech community for granted for years, the state finally decided to get into the game and see how it could help. A lot of that talent is coming out of big biotechs like Biogen Idec ($BIIB), Genzyme and now Vertex ($VRTX). And the new crop of companies in turn will create more CEOs and CSOs and business development chiefs in waiting. In economic development circles, there's a long-standing belief in the 50-mile rule. New companies are always headquartered within 50 miles of where the CEO wants to live. In biotech, you can say the same for VCs. Who wants to travel all over the world when you're shepherding a dozen different investments? The 50-mile rule has been very kind to the Boston economy. -- JC Back to top | Back to chart

Once you move past the top two cities in the list, the deal numbers start to plunge. But San Diego has retained a top reputation as a significant biotech hub, with a mix of VCs and Big Pharmas at work in the area to help bolster the prospects of the drug development industry. GlaxoSmithKline ($GSK) decided last fall to dispatch an R&D team to San Diego, which will be complemented by another team across the country in the biotech hotbed around Boston. GSK settled on San Diego after doing a deal with Avalon's Jay Lichter to start up 10 new biotechs under the VC's guiding hand. Avalon plans to launch about one new biotech every quarter. Meanwhile, a well-established group of developers like Celladon, a 2012 Fierce 15 company, call San Diego home. UC San Diego's $362 million in NIH financing in 2013 qualified for the country's top 10 research institutions. And speaking of top research groups, Scripps keeps the ideas coming. One of its most recent spinouts is Abide Therapeutics, now teamed with Merck ($MRK) and Celgene ($CELG). But current hub trends have also cost San Diego biotech jobs. Novartis ($NVS) shut down a development unit in La Jolla as it concentrated efforts around Boston. And the high-risk nature of drug development has also cost it some company failures along the way. This year, though, both BIO and the DIA are hosting their annual conferences in San Diego, which should help shine a light on the local biotech community. -- JC Back to top | Back to chart

4. Washington, DC

$319.65 million

The DC region often gets overlooked when the discussion turns to significant biotech hubs. And that's a pity. A generous amount of specialized investing by government agencies like DARPA, to say nothing of the billions that rolls out of an NIH which is increasingly focused on translational medicine--otherwise known as very early product development work--has made this area a hive of drug development work. Nearby Gaithersburg, MD, is home to the ambitious MedImmune, AstraZeneca's ($AZN) biologics development arm. And the government's investment in antiterror activities has helped scare up money for new vaccines against some deadly agents that theoretically could fall into the wrong hands. The DC region's $319 million in venture activity is nothing to scoff at. And while it may not count a large number of biotechs that call it home right now, all the ingredients are in place for steady growth. -- JC Back to top | Back to chart

5. Oakland, CA

$261.63 million

By Oakland the NVCA means the East Bay region, which includes such hotbeds of biopharma activity as Hayward. Nearby Newark, CA, is home to Revance Therapeutics. And with Pleasanton, CA-based SFJ--a new kind of drug developer that takes on Phase III risk for its partners--the two biotechs alone accounted for $100 million of the venture total. CymaBay ($30 million and another resident of Newark), the U.S./China biotech hybrid MicuRx ($25 million) and Tethys Bioscience ($19 million) also helped add to the total for the East Bay. As noted above, if you add in the East Bay along to the numbers given for greater San Francisco, the region even more easily beats out the Boston region--generally credited as ground zero in the biotech venture scene. -- JC Back to top | Back to chart

While it may not have as many biotechs as Boston or command the Bay Area's billions, Seattle is inculcating a life sciences hub in miniature, matching local research talent with a growing VC scene and a few major anchor tenants. And Seattle happens to be home to the biotech that roped in 2013's biggest single round: Juno Therapeutics, headquartered just south of Lake Union, bagged a whopping $120 million Series A to develop its take on the en vogue CAR-T pathway for treating cancer. Juno's technology is based in part on the work of Seattle's Fred Hutchinson Cancer Research Center, and local VC Arch Venture Partners ponied up for the raise, making the jumbo-sized A round a banner example of the potential of the area's inchoate biotech industry. And there's plenty of reason to believe the next Juno will be Seattle-bred, too. The metro area is also home to the research-minded meccas of two local billionaires--the Allen Institute for Brain Science and the Bill & Melinda Gates Foundation--plus VC mainstay Frazier Healthcare, which just closed a new $377 million fund, and local players Seattle Genetics ($SGEN) and Dendreon ($DNDN). -- Damian Garde (email | Twitter) Back to top | Back to chart

7. New York City

$135.06 million

Despite being the financial center of the world's largest economy and boasting a bevy of A-list research institutions, New York City has never evolved into the biotech hotbed many hoped it would become. But thanks to a public-private endeavor launched in the waning days of Michael Bloomberg's reign, that may soon change. Local luminaries Celgene ($CELG) and Eli Lilly ($LLY) are teaming up with the city to help launch a $100 million program that aims to found up to 20 biotechs in New York City, betting that innovations from the likes of the Weill Cornell Medical College and Columbia University Medical Center combined with some state-of-the-art real estate can lure or launch promising startups. What's been missing all along, according to local trade groups, is complementary interest from the venture community, but New York need not look beyond its area code for some major life sciences VCs. OrbiMed Advisors, which unveiled a $735 million new fund last year, calls New York home, as do life sciences financiers New Leaf Venture Partners and Apax Partners, among many others. And the city has a model for success in one of the stars of last year's IPO class: Ophthotech ($OPTH), located across the street from Madison Square Garden, had already amassed more than $200 million in venture cash when it bagged $167 million in a September debut, filling its coffers as it moves into Phase III with a promising eye drug. -- DG Back to top | Back to chart

8. Philadelphia

$133.4 million

The City of Brotherly Love may not quite measure up to New York City in VC dollars, but Philadelphia and its attendant sprawl more than surpassed their northern neighbor in companies funded, reflecting the vibrant life sciences environment in the Mid-Atlantic's largest city. Thanks to a steady stream of discoveries from top-tier institutions like the University of Pennsylvania and a healthy funding climate led by local investor Quaker Bio, greater Philadelphia has becoming a welcoming environment for biotech startups and Big Pharma alike, as global giant GlaxoSmithKline ($GSK) has planted deep roots in the area. And, thanks to Philadelphia's biomedical pedigree, startups don't necessarily have to wait around for venture interest to get rolling: Local gene therapy upstart Spark Therapeutics spun out of the Children's Hospital of Philadelphia last year with $50 million from its parent and a mission to make a difference in debilitating disease. But VC interest is likely only to grow after the string of successful IPOs Philadelphia-area biotechs pulled off last year. Newtown's Onconova ($ONTX) pulled in nearly $80 million in its debut, while the King of Prussia-headquartered Trevena ($TRVN) bagged $65 million and TetraLogic ($TLOG) cashed out for $50 million. -- DG Back to top | Back to chart

9. Northern New Jersey

$131.83 million

With the flight of major tenant Roche ($RHHBY) saddling Nutley, NJ, with a biopharma ghost town, much of the focus on North Jersey's life sciences market has been the scramble to fill the drugmaker's shoes. However, just down the Garden State Parkway is a growing biotech community. South of New York City and north of Philadelphia, below the Bay Area's churning scene but well above what most would assume, the area's life sciences cluster has become a hotbed of activity. Last year saw sizable fundraises for Princeton's Celator and Bridgewater's Drais, plus IPOs for South Plainfield's PTC Therapeutics ($PTCT) and Basking Ridge's Regado Biosciences ($RGDO), to name a few. The wide stretch of land between Somerset and Hunterdon is home to CROs, research institutions and Big Pharma outposts, all necessary ingredients for a nascent biotech boom. Furthermore, with top-tier VC Domain Associates making its home in Princeton and dealmaker extraordinaire Celgene ($CELG) up the road in Summit, innovative drug developers shouldn't have to look far for a shot at finding some financing. -- DG Back to top | Back to chart

10. Raleigh-Durham, NC

$118.43 million

There's quite a bit of ingenuity between the University of North Carolina at Chapel Hill, Duke University and North Carolina State University, and the southern triumvirate has seeded multiple generations of promising biotechs over the years, making the Research Triangle a go-to stop for VCs from around the globe. Tobacco Road boasts a sort of all-encompassing biotech ecosystem, including academic labs, private medical centers and a host of CROs, making it entirely possible to take a molecule from discovery to approval without leaving the area code. And the industry is well aware. Bayer, Merck ($MRK), GlaxoSmithKline ($GSK) and many other heavyweights all have outfits in Research Triangle Park, and the region's brisk pace of venture action suggest that financiers share that affinity. Last year, local biotech Envisia lured Canaan Partners and New Enterprise Associates with its inaugural raise; regenerative medicine specialist Tengion scored $33.6 million from the likes of Celgene ($CELG) and Bay City Capital; and Argos Therapeutics ($ARGS) racked up $60 million for its personalized cancer vaccine, later banking $45 million more in an IPO. -- DG Back to top | Back to chart

While it can hardly contend with this list's top 10 in dollars, deals or biotechs, the Queen City's pedigree of medical research has made it a surprisingly fertile ground for life sciences companies. Leading the way is Akebia, a Cincinnati-headquartered Procter & Gamble ($PG) spinout pushing through midstage trials with a novel anemia drug. The biotech banked $41 million in VC cash last year, bringing its 7-year haul to $87 million, and is now swinging for a $75 million IPO to get the treatment through Phase III. And Akebia's expertise ran deep enough to spur a spinoff of its own: Aerpio Therapeutics, developing a treatment for vascular disease, closed a $27 million round the year before. Much of the city's promise rests on its research community, including the University of Cincinnati Medical Center and the Cincinnati Children's Hospital Medical Center, which has taken a lead role in the push to develop medical devices fit for children, teaming up with Israel's Ben-Gurion University on a pilot project. -- DG Back to top | Back to chart

Thanks in large part to the influence of the University of Colorado in nearby Boulder, the Denver metro area is home to a small but growing life sciences community, and while its 2013 haul pales in comparison to those of the nation's established hubs, the Mile High City is shaping up to be a fertile ground, particularly for med tech companies. Last year, molecular diagnostics outfit Biodesix hauled in $8.3 million, medical device company SureFire Medical picked up $18.2 million, blood test specialist SomaLogic raised $10 million, and orthopedic implant maker Lanx raised $15 million before spinal giant Biomet scooped it up for an undisclosed sum. And while Denver's output leans toward devices and diagnostics, the area's drugmakers include Clovis Oncology ($CLVS), which raised $275 million in a public offering last year, Ampio Pharmaceuticals ($AMPE), which cleared $25 million in a direct placement, and vaccine developer Inviragen, which Takeda snagged for up to $250 million in May. -- DG Back to top | Back to chart

13. New Haven, CT

$50.17 million

Last fall, when Canaan Partners' Tim Shannon teamed up with 5AM Ventures to launch the Yale spinout Arvinas, he noted his own close ties to Yale. And he was also careful to highlight the state of Connecticut's $4.25 million contribution to the cause as state officials followed through on the governor's commitment to build up biotech in the wake of Pfizer's ($PFE) big downsizing. That combination of academic prowess, venture's deep pockets and a state determined to spawn more such biotechs explains why New Haven made it on this list. Connecticut may not be the first place that biotech entrepreneurs have in mind when they start a company, but when the circumstances are right it can make a lot of sense. -- JC Back to top | Back to chart

14. Los Angeles

$45.96 million

When Beverly Hills, CA-based Capricor Therapeutics recently announced an option deal with Johnson & Johnson ($JNJ), the little stem-cell company with a pair of clinical-stage programs stood out as a rare biotech denizen of one of the most chic spots in America. It's not often that you find a drug developer within range of Hollywood Boulevard. But it's also not that common to find many venture-based biotechs in the entire metro area. Not that there isn't some substantial R&D in the area. Allergan ($AGN) in Irvine has been pumping money into its own research operations. And biotech billionaire Patrick Soon-Shiong recently inked a deal with some close associates at Celgene ($CELG), which is investing $75 million in his biotech startup. Soon-Shiong--who sold Abraxis and Abraxane to Celgene for $3 billion--says he's invested $100 million in an ambitious effort to revolutionize cancer care. That dwarfs the total amount of venture cash to flow to a half-dozen biotechs. -- JC Back to top | Back to chart

The big question about Chicago may be why it's all the way down at the bottom of this list. This is the city, after all, that hosts the annual ASCO meeting, the largest gathering of cancer specialists anywhere. Anyone interested in oncology R&D development has to go to Chicago every year. AbbVie is up north, making considerable progress in coming up with a new generation of drugs to succeed Humira. And Astellas Pharma US is up on the northern edge of Chi-town. But for venture players, Chicago is still largely fly-over land, or where they drop in at O'Hare to make a connection to the coast. Nice place to visit, wouldn't want to run a biotech here. The city and the state, meanwhile, gamely plug along, regularly hosting annual meetings of BIO while talking up its prospects and inflating the number of people who work in the industry any way they can. Economic development officials wouldn't be doing their job if they didn't routinely inflate figures and impact. So far, though, the numbers aren't adding up. -- JC Back to top | Back to chart