|

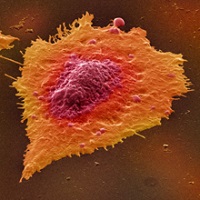

| Human colon cancer cell--Courtesy of Annie Cavanagh, Wellcome Images |

With the help of open-minded regulators, pharma companies have ditched the traditional march through three phases of clinical trials for some cancer drugs. Trials of targeted drugs offer rapid proof of efficacy against molecularly defined malignancies, giving the authorities a basis for approvals before late-stage studies to prove that therapies prolong the lives of patients.

In our third annual report on 10 exciting cancer drugs, there are plenty of R&D programs zipping through trials with the blessing of the FDA, which has awarded "breakthrough" status for expedited development to treatments in oncology more than any other field. Take Novartis' LDK378, one of the featured treatments in this report. In March the next-gen ALK inhibitor joined the "breakthrough" club amid Phase II trials, and Novartis ($NVS) said it would seek FDA approval next year with only three years of development.

This explains why we've dropped "late-stage" from the title of this report, as several featured programs are in midstage development.

Oncology is the most crowded area of drug research. So the shorter development cycle helps limit companies' risk of chasing the same or very similar targets as a bevy of other companies, wagering on their program to come out on top. Novartis might have the frontrunner with LDK378, but it is one of no fewer than four experimental compounds against ALK in lung cancer. These drugs home in on misfit proteins in an ALK-positive subgroup that represents as little as 3% of the NSCLC population.

The FDA is opening the inside track to more genetic therapies in response to overwhelming patient need, as the efficacy of the first wave of gene-targeting drugs fades after clever cancers adapt and find new pathways to grow out of control. Roche ($RHHBY) and other companies also face patent expirees to existing drugs, and the Swiss drugmaker has mounted an effort to make one of its best drugs, Rituxan, even greater with a glycoengineered successor called GA101.

Targeted or not, none of these drugs is a silver bullet, and patients must still endure side effects. Yet there's hope for some cancers to become manageable chronic illnesses as opposed to death sentences. Bristol-Myers Squibb ($BMY), Merck ($MRK) and others in this report have also advanced drugs based on discoveries of how to restore natural immune attacks on cancer. In fact, three immunotherapies that travel the programmed death pathway to kill cancer have made our top 10 this year.

Please read the report and share your thoughts on the programs by tweeting links to the report along with the hashtag #10CancerDrugs. Feel free to tweet about these programs during the ASCO meeting, which begins this week. -- Ryan McBride (email | Twitter) | John Carroll (email | Twitter) | Emily Mullin (email | Twitter)

For more:

FDA oncology chief Pazdur vows to accelerate 'breakthrough' drug R&D

ASCO confab highlights immunotherapies, 'breakthrough' drugs and small victories

Top 10 Late-Stage Cancer Drugs – 2012

10 promising late-stage cancer drugs - 2011

Ibrutinib (PCI-32765)

Ibrutinib (PCI-32765)

Target: BTK inhibitor

Disease focus: B-cell cancers

Developers: Pharmacyclics ($PCYC), Johnson & Johnson ($JNJ)

Ibrutinib has sparked a frenzy of activity in the clinical and investment worlds with promising evidence of efficacy in a lineup of B-cell cancers. The blockbuster prospects of the Bruton's tyrosine kinase (BTK) inhibitor have driven the market value of its developer, Pharmacyclics ($PCYC), to more than $5 billion, the highest among clinical-stage companies in the oncology arena, and stamped company CEO and Chairman Bob Duggan's ticket into the billionaire's club.

As one physician described ibrutinib to a Forbes scribe recently, the compound could become the Gleevec of B-cell cancers such as chronic lymphocytic leukemia (CLL) and mantle cell lymphoma. Now in Phase III studies, ibrutinib has shown impressive response rates and progression-stealing results in midstage tests. In a Phase Ib/II study in CLL patients, for instance, cancer progression halted in an estimated 96% of patients without prior treatment and 75% of those with high-risk cases at up to 26 months after they started to take ibrutinib.

Johnson & Johnson ($JNJ) wants to add the compound to its growing roster of cancer therapies, and the pharma giant and Pharmacyclics have raced ahead with 5 late-stage clinical trials for the experimental drug through their collaboration that began in December 2011. The partners have already found a supportive audience with the FDA, which has granted three "Breakthrough Therapy" designations for the compound for use in separate pools of cancer patients.

With the first submission for FDA approval expected in the third quarter of 2013, Pharmacyclics and J&J could win a quick stamp from the agency and have ibrutinib cleared for the U.S. market before the end of the calendar year. The pace of the agency's action on the application will speak volumes about the value of "Breakthrough" status. If approved for CLL and other uses, analysts estimate that ibrutinib could become one of the biggest moneymakers in oncology with up to $5 billion in annual sales.

Ibrutinib took an improbable path to oncology stardom, Forbes reported. Before former Pharmacyclics CEO Richard Miller championed development of the compound for B-cell malignancies, ibrutinib had found work in the labs of its previous owner, Celera, as a test molecule because of its ability to form permanent bonds with BTK. Pharmacyclics took a gamble on drug development in cancer, and the rest is history.

For more:

Pharmacyclics bounces higher as J&J wins third 'breakthrough' cancer drug coup

J&J, Pharmacyclics score 'breakthrough' coup with blockbuster hopeful ibrutinib

Nivolumab (BMS-936559)

Target: PD-1 inhibitor

Disease focus: Solid tumors

Developers: Bristol-Myers Squibb ($BMY), Ono Pharmaceutical

Nivolumab has emerged as a leading immunotherapy in a new class of drugs in the programmed death 1 (PD-1) pathway. Bristol-Myers Squibb, the drug's developer, and others have banked on such therapies that work directly with native immune responses to bolster attacks on cancer--particularly against solid tumors for which progress in drug development has been painfully slow for decades.

Soldier T cells are supposed to slay cancer cells in the body and normally do, yet people get sick when tumors take the PD-1 route to throw off the agents of the immune system. As described last year in Oncology, the pathway blocks immune attacks on cancer when PD-1 receptors on activated T cells and PDL-1 ligands on tumor cells meet. Bristol-Myers, Merck ($MRK) and Roche ($RHHBY) are developing similar drugs that could tip the scales back in favor of the immune system in the body's own war on cancer.

Bristol-Myers has mounted 6 late-stage studies of nivolumab, which targets the PD-1 receptor on T cells, across a variety of solid tumors. The FDA has granted fast-track status to the company for development of the drug in melanoma, lung cancer and kidney cancer. These are some of the most prevalent cancers on the planet with some of the worst prognoses for patients. If effective against lung cancer, nivolumab could hit sales levels akin to Roche's megablockbuster Avastin, Barclays analyst Tony Butler told Bloomberg recently.

Nivolumab has garnered the spotlight in oncology based largely on data from early-stage development. Bristol-Myers appears to have an edge over competitors in advanced melanoma, for which the company is developing the PD-1 drug in combination with its marketed immunotherapy Yervoy. The combo shrank the deadly skin tumors by more than 80% in 12 weeks in a small study, providing evidence that the two therapies together could work better than Yervoy alone.

Bristol-Myers grabbed rights to both Yervoy and nivolumab in a 2009 buyout of Medarex for $2.4 billion, a bargain sum in light of recent data on the two therapies. Nivolumab resulted from research between Medarex and Ono Pharmaceutical, which has held onto rights to the therapy in the key Asian markets of Korea, Japan and Taiwan.

For more:

Bristol-Myers' immunotherapy drug nivolumab takes center stage at ASCO

Bristol-Myers edges ahead in race to develop first blockbuster PD-1 cancer drug

Next-gen cancer immunotherapies will step into the spotlight at ASCO

Target: Inhibitor of cyclin-dependent kinases (CDK) 4 and 6

Disease focus: Metastatic breast cancer

Developer: Pfizer ($PFE)

Palbociclib has shown powerful effects in women with a common molecular form of metastatic breast cancer, prompting industry watchers to pump up the market potential of the oral agent. Pfizer CEO Ian Read has trumpeted the inhibitor of CDK 4 and 6 as a leading late-stage contender in the drug giant's resurgent R&D pipeline, and the FDA designated the compound as a "Breakthrough Therapy" with all the speedy development and review benefits of the status in April.

Breast cancer is the leading cause of cancer death in women. A variety of molecular drivers make breast cancer a heterogeneous disease, yet Pfizer investigators have found impressive evidence of efficacy for palbociclib in postmenopausal women with an ER-positive, HER2-negative form of the cancer. This molecular makeup represents 60% of postmenopausal cases of aggressive or metastatic breast cancer, making it the largest subgroup in this diverse population of cancer patients.

In December investigators impressed analysts with interim Phase II data that showed how breast cancer patients on palbociclib and Novartis' ($NVS) standard antihormone therapy Femara went more than 18 months longer without their disease worsening compared with patients on Femara alone. Based on the signs of efficacy against the major illness, Citigroup's Andrew Baum estimated potential annual sales of $5 billion. Yet industry watchers await full data from the study and evidence of improved overall survival, the true mark of a breakthrough.

With palbociclib, Pfizer is forging ahead in an area of oncology drug development with few successes. The drug targets two triggers in the tumor cell cycle to stymie development of cancer cells before DNA replication and cell division. Eli Lilly ($LLY) has a CDK 4/6 inhibitor of its own called LY2835219 in early stage development for advanced tumors and a Phase II study in patients with mantle cell lymphoma.

Pfizer has engineered a wide-ranging development program to study palbociclib for patients with a variety of cancers, some of which include ovarian cancer, multiple myeloma and acute lymphoblastic leukemia.

For more:

FDA stokes blockbuster hopes with 'breakthrough' brand for Pfizer cancer drug

Pfizer seeks inside track at FDA for blockbuster breast-cancer hopeful

Pfizer eyes PhIII with impressive data for breast-cancer fighter

Obinutuzumab (GA101)

Obinutuzumab (GA101)

Target: CD20

Disease focus: Chronic lymphocytic leukemia

Developer: Roche Glycart

Experts have reserved final judgment on Roche's next-generation anti-CD20 antibody obinutuzumab (GA101), awaiting details about the overall survival benefit for leukemia patients on the drug and watching for more data on how the experimental therapy stacks up against its predecessor, Rituxan, for multiple blood cancers. Yet the Swiss drug giant has delivered evidence that GA101 could best its blockbuster Rituxan, giving the company a potential successor to one of its most important oncology franchises.

Roche ($RHHBY) has already filed for approval of GA101 for chronic lymphocytic leukemia in the U.S. and Europe, and on May 16 the company revealed initial results from a two-part Phase III study in CLL patients. The preliminary results showed that patients on GA101 and chemotherapy lived for 23 months without their cancer worsening with tumor shrinkage of 76%, besting the 10.8 months of progression-free survival (PFS) and 30% tumor reduction in those on chemo alone, and edging the median 15.7 months of PFS and 66% response rate in the group on Rituxan and chemo.

The company expects to reveal more details from the study at the major ASCO meeting on June 4, and GA101 and Rituxan go head-to-head in the next leg of the Phase III trial. The two drugs are also facing off in studies of patients with non-Hodgkin lymphoma and diffuse large B-cell lymphoma. Safety, of course, will also come into play. And the GA101 data showed greater percentages of patients with low white blood cell counts and infusion site reactions than in the chemo-only and Rituxan arms of the Phase III CLL study.

"In theory it's a smarter-designed version of Rituxan," Tim Race, a London-based analyst for Deutsche Bank AG, said in a Bloomberg interview before the pre-ASCO results were unveiled. "The problem is that Rituxan is a brilliant drug, and being better than a brilliant drug is always difficult."

Roche Glycart has glycoengineered GA101 to work alongside the natural immune system in fighting cancer while mounting direct attacks on tumors in an effort to improve on Rituxan, which faces biosimilar competition in the coming years. The FDA has seen enough promise in the heir to Rituxan to give GA101 a "Breakthrough Therapy" designation, which is supposed to expedite the review of drugs for patients in need.

Biogen Idec ($BIIB), which discovered Rituxan, has shared expenses for developing GA101 and has rights to 35% of U.S. commercialization on the therapy under a pact with Roche's Genentech.

For more:

Roche's next-gen Rituxan candidate impresses in first look at PhIII data

Roche bets on PhIII contender to succeed its bestselling cancer drug

Genentech flashes PhIII progress for prized Rituxan successor

Lambrolizumab (MK-3475)

Class: Anti-PD-1 antibody

Disease focus: Melanoma

Developer: Merck

Last fall, Merck ($MRK) grabbed the attention of the oncology community with some impressive Phase Ib interim data for lambrolizumab. After obtaining 12-week results on 85 of the 132 melanoma patients in the trial, investigators concluded that the drug triggered a 51% response rate and a 9% complete response rate. None of the patients receiving Yervoy--one of the most impressive immunotherapy treatments now on the market--had a complete response and a relatively low 41% scored an objective antitumor response.

For Merck, which quickly followed up by winning the coveted "breakthrough" drug designation for the treatment, the data could pave the way to a fast approval. Now Merck is waiting for potentially pivotal data from a Phase II study involving pretreated patients that the pharma giant believes may be good enough to win an approval, and that kind of aggressive timetable puts it in a head-to-head showdown with Bristol-Myers Squibb ($BMY), which has its own PD-1 drug to boast about.

Merck rarely finds itself in such a fast crowd. The pharma giant's R&D wing is known for taking its time when it comes to nailing down pivotal data. Merck was also hit with an FDA rejection for ridaforolimus last year, a familiar setback for the company. To discuss seeking a possible approval after a midstage trial would amount to a culture shift that some analysts had all but given up on.

But nobody believes that it will be easy. Bristol-Myers Squibb's PD-1 program--targeting a self-defense mechanism used by cancer cells--can rely on combo data involving the anti-CTLA-4 antibody Yervoy, giving the company a distinct edge in terms of scoring best-in-class status.

Merck also has to compete with a heavyweight cancer team at Roche ($RHHBY), which has its own particular take on PD-L1. Analysts will look to Merck to clarify the most recent data on this drug at ASCO, where it's headed straight for the spotlight--ready or not.

For more:

Merck's 'breakthrough' PD-1 cancer drug in showdown with Bristol-Myers combo

Bristol-Myers edges ahead in race to develop first blockbuster PD-1 cancer drug

Merck spotlights new deals, R&D review as demands to rebuild pipeline grow

Merck scores 'breakthrough' status from FDA for immunotherapy against melanoma

![]()

LDK378

Target: Selective inhibitor of anaplastic lymphoma kinase (ALK)

Disease focus: Non-small cell lung cancer

Developer: Novartis ($NVS)

Novartis ($NVS) has taken a leading position in the development of next-generation ALK inhibitors for non-small cell lung cancer (NSCLC) with LDK378, and the drug giant has gained the inside track on rapid development and potential approval for the U.S. market with a "breakthrough" tag from the FDA.

From the moment the FDA pinned the status on LDK378 in March, based on promising results of an 88-patient Phase I study, Novartis has trumpeted plans to file for an approval in 2014. The company expects to ask the FDA for market sanction after advancing the drug through Phase II studies, testing the pledge of the "breakthrough" program to deliver new therapies to patients on an expedited schedule.

Non-small cell lung cancer is the leading cause of cancer deaths, yet only 3% to 8% of patients have ALK-positive tumors. Pfizer ($PFE) pioneered this market with its approved drug Xalkori, and now Novartis, Ariad Pharmaceuticals ($ARIA) and Tesaro ($TSRO) and Chugai are racing to develop next-generation ALK blocks for lung cancer patients. Novartis' LDK378 has set the bar high for the next-gen players, posting an 80% response rate in patients whose NSCLC progressed after treatment on Xalkori.

Despite the drug's frontrunner status, LDK378 will initially tackle a limited segment of the lung cancer market. The drug may never end up in the blockbuster category, though the speedy three-year development cycle expected for filing for approval of the drug as well as the highly targeted attack on ALK highlight trends in oncology that could bode well for patients and companies in the field.

"At the end of the day, this is about giving in to patients' demand for faster access," Helvea analyst Olav Zilian told Bloomberg of the "breakthrough" program. "The proof that the drug works will have to be handed in later."

Novartis expects to provide more data on LDK378 at the upcoming ASCO meeting. Doctors and patients are clamoring for more ways to fight lung cancer, the leading cause of cancer deaths in the U.S., of which NSCLC is the most common form.

For more:

Novartis promises to test the full value of FDA's 'breakthrough' status

Novartis grabs FDA's coveted 'breakthrough' status for lung cancer drug

Talimogene laherparepvec (OncoVex)

Talimogene laherparepvec (OncoVex)

Class: Oncolytic virus

Disease focus: Melanoma

Developer: Amgen (acquired from BioVax in 2011)

In the March 2011 buyout of Woburn, MA-based BioVex (a 2009 Fierce 15 company), Thousand Oaks, CA-based Amgen ($AMGN) bought talimogene laherparepvec for $425 million up front and up to $575 million in milestones.

An injectable oncolytic immunotherapy, the drug is designed to selectively replicate in tumor tissue. Once injected, it then replicates inside tumor cells until the membranes of the cancer cells rupture, destroying the malignant cells in a process known as cell lysis. The engineered virus is then freed from the cells along with the white blood cell growth factor GM-CSF, which the virus is designed to express. This process activates a systemic immune response to kill cancer cells in the body.

In March, Amgen revealed upbeat data for talimogene laherparepvec--an engineered cold sore virus--when the drug successfully shrank tumors in patients with late stages of the disease. In the Phase III study of more than 400 trial patients, 16% given the engineered virus had a durable response compared with 2% of patients taking the control therapy, GM-CSF. The Amgen drug also showed a trend toward overall survival compared to the control drug.

"A high unmet need exists in melanoma and we believe the innovative mechanism of action of talimogene laherparepvec may offer a promising approach for these patients," said Dr. Sean Harper, executive vice president of research and development at Amgen, in a previous statement.

Melanoma remains a huge public health concern, and skin cancer tops the list of the most common forms of cancer in the U.S. Rates of melanoma, which make up only 5% of cancers but 75% of skin cancer deaths, are rising, especially among young people.

For more:

Special report: Talimogene laherparepvec (OncoVex) – Top 10 Late-Stage Cancer Drugs – 2012

Amgen scores PhIII success with BioVex virus against melanoma

Amgen bets $1B on BioVex's dual-mechanism cancer therapy

Daratumumab

Class: Whole antibody

Disease focus: Multiple myeloma

Developers: Johnson & Johnson/Janssen, Genmab

While not known as the biggest dealmaker in Big Pharma, Johnson & Johnson ($JNJ) scooped up rights to the promising cancer antibody daratumumab from Genmab in August 2012 development pact, taking an $80 million equity stake in the Danish biotech plus $55 million upfront. Including potential milestones, the deal is valued at $1.1 billion.

In preclinical studies, daratumumab successfully destroyed multiple myeloma cells while improving the effectiveness of other multiple myeloma treatments. And after Genmab reported encouraging preliminary results in June 2012 from a Phase I/II clinical trial in relapsed multiple myeloma patients, the FDA bestowed the drug with Fast Track Designation and Breakthrough Therapy Designation for the treatment of patients with multiple myeloma. The latest trial results that came out in December 2012 back up initial findings of daratumumab's potential as a single-agent antimyeloma therapy.

Daratumumab works by targeting the CD38 molecule expressed on the surface of multiple myeloma cells. The drug has multiple mechanisms of action designed to single out cancer cells--complement-dependent cytotoxicity (CDC), antibody-dependent cell-mediated cytotoxicity (ADCC), antibody-dependent cellular phagocytosis (ADCP), apoptosis and modulation of CD38 enzymatic activity.

Daratumumab could potentially be effective at fighting other hematological tumors that express CD38, including diffuse large B-cell lymphoma, chronic lymphocytic leukemia, acute lymphoblastic leukemia, acute myeloid leukemia, follicular lymphoma and mantle cell lymphoma.

Multiple myeloma, a cancer of the plasma cells, happens when abnormal plasma cell deposits build up in the bone marrow, where they interfere with the production of normal blood cells. The condition is the second most common hematological cancer in the U.S., behind non-Hodgkin lymphoma, and it makes up about 1% of all cancers.

The average survival rate for the disease is only three to four years with conventional treatment, but breakthrough treatments such as Velcade, sold by Takeda and Johnson & Johnson ($JNJ), and Celgene's ($CELG) Revlimid have been able to prolong patients' lives a few years. Despite these advances, there is still more work to be done in the field.

For more:

J&J grabs another 'breakthrough' FDA win with early-stage cancer drug

Biotech benefits from 'breakthrough' guess for its cancer med partnered with J&J

J&J grabs Genmab's promising leukemia antibody in $1.1B deal

Class: PI3K delta inhibitor

Disease focus: Chronic lymphocytic leukemia and indolent non-Hodgkin's lymphoma

Developer: Gilead Sciences

Don't ever underestimate Gilead ($GILD). When the Big Biotech company puts an R&D program on the company's fast track, it is perfectly willing to spend big to push the development program at record pace. It proved that with the hepatitis C program for sofosbuvir, and now it's showing the same sense of urgency with idelalisib.

It's no coincidence that Gilead published some impressive results on CLL just ahead of ASCO. Acquired from Calistoga in a high-profile deal that highlighted Gilead's interest in expanding into the cancer drug field, the treatment spurred a complete response rate of 19% and an overall response rate of 97% in CLL patients in Phase II, with estimated progression-free survival at 24 months of 93%. Investigators reported significant tumor shrinkage in half of the 54 patients who received it. Disease progression was delayed by 17 months on average. And those patients had already failed a slew of existing drugs.

Phase II data for slow-moving cases of non-Hodgkin's lymphoma are just around the corner, and Gilead has already launched a Phase III program for this treatment. If final Phase II data from an ongoing study come in positive, Gilead has said that it may just push ahead and ask for an approval now.

Idelalisib targets a subset of PI3K proteins that is known to accelerate the development of cancer, the kind of clear biologic pathway the FDA enjoys. As a result, it's in direct competition with IPI-145, a PI3K delta and gamma inhibitor in development at Infinity Pharmaceuticals ($INFI), which has been winning some enthusiastic supporters with evidence of possibly greater activity and lower liver toxicity. But while Infinity has been focusing on restructuring the company around IPI-145, which is now delivering Phase I data, Gilead has been ramping up its late-stage clinical campaign, putting its drug well in the lead. And now Infinity may be forced to settle for next-gen drug status as it watches Gilead hustle ahead.

It certainly doesn't lack for attention. ASCO President Sandra Swain called the recent results "pretty incredible," while Dana-Farber's Jennifer Brown enthused: "Drugs like idelalisib are probably going to change the landscape of the disease in the next few years."

For more:

Gilead speeds ahead on idelalisib with promising leukemia data

MPDL320A

MPDL320A

Target: PD-L1

Disease focus: Kidney, lung, colon and gastric cancers

Developer: Genentech/Roche

Genentech has been brewing its own new cancer immunotherapy that could eventually rival PD-1 drugs from Bristol-Myers Squibb ($BMY) and Merck ($MRK). The U.S. subsidiary of Roche ($RHHBY) generated some positive buzz for its experimental immunotherapy MPDL320A last month at the American Association for Cancer Research (AACR) meeting, where investigators highlighted positive signs of safety and antitumor activity from Phase I development.

Genentech aims to take a different route to restore immune attacks on cancer. Its immunotherapy targets PD-L1 on cancer cells, which use the programmed death ligand to thwart attacks from immune cells that express PD-1. Bristol-Myers and Merck have more advanced programs for nivolumab and lambrolizumab, respectively, yet those drugs target PD-1 on immune cells. And investigators for Genentech's studies have noted that PD-L1 targeting could be safer because therapies that home in on PD-1 could impact healthy cells with PD-L2 targets and cause inflammation in the lungs, Reuters reported last month.

At the AACR meeting, Genentech revealed data showing antitumor activity for MPDL320A in patients with kidney, lung, colon and gastric cancers. The company has already registered trials to test the immunotherapy in combination with its marketed cancer drugs Zelboraf, for melanoma, and Avastin for multiple cancers. The combo approach has caught on with immunotherapies. Bristol-Myers might have the upper hand in melanoma because of evidence that its approved Yervoy and experimental nivolumab work better together than Yervoy alone.

Roche, which of course owns Genentech, has the largest cancer business on the planet, with plenty of existing therapies to pair with MPDL320A. It's still early days for therapies that target the PD pathway, and Genentech's contender has a real chance to become a great drug. Analysts are projecting the immunotherapy class to generate monster revenues of $35 billion, with multiple blockbuster products contributing to the megablockbuster pot.

Right now, Roche/Genentech has a shot to become a major player in this emerging field and maintain its top position in oncology.

For more:

Merck's 'breakthrough' PD-1 cancer drug in showdown with Bristol-Myers combo

Genentech steps into spotlight with closely-watched cancer immunotherapy

(Top 10 report ends here.)

Up-and-comer... BIND-014

Target: PSMA-targeted nanoparticle containing docetaxel

Disease focus: Lung, prostate and bladder cancers

Developer: Bind Therapeutics

While easily the least proven candidate in this report, BIND-014 has shown early promise in combatting a range of solid tumors in Phase I trials, and Bind Therapeutics plans to prove the mettle of its lead candidate in three Phase II trials slated for this year in lung, prostate and bladder cancers.

Cambridge, MA-based Bind highlighted the Phase I data on 014, which encapsulates the chemo drug docetaxel in a nanoparticle, in an oral presentation at the American Association for Cancer Research. Getting the spotlight at AACR is no small deal. In 28 cancer patients who had already received a battery of treatments, Bind's drug shrank or stabilized tumors in 9 patients, including a complete response in a patient with cervical cancer as well as partial responses in patients with non-small cell lung, prostate and ampullary tumors.

Bind has a long way to go with this program. Yet based on early work with its Accurin nanotechnology platform, the company has landed a troika of major corporate partnerships this year on other assets with Amgen ($AMGN), Pfizer ($PFE) and AstraZeneca ($AZN). Those deals improve the odds of a success from Bind's technology, which came from labs of MIT inventor Bob Langer and his colleagues.

As Bind CEO Scott Minick says, the company has the ability to target cancer in a variety of ways. The BIND-014 candidate targets prostate-specific membrane antigen (PSMSA) found on cancer cells of multiple types of tumors and cancer blood vessels, and the shape of the molecule helps it infiltrate leaky vessels associated with tumors.

Bind's lead drug could easily crash and burn, yet the nanomedicine could wallop difficult-to-treat tumors and represents the kind of innovation that at least three major drugmakers have lined up to access this year.

Those partnerships could be just noise where the promise of 014 is concerned, yet it's way more fun to spotlight an exciting potential breakthrough than give another round of applause to a good-enough drug. Let's call BIND-014 a "bonus" item. Though it's not in our top 10, it's certainly one that could emerge as a top program by this time next year.

For more:

BIND Therapeutics completes PhI trial of first Accurin cancer drug

Langer's Bind Biosciences raises cash as lead cancer program heads to PhII

Nanomedicine standout spotlights first human cancer data