|

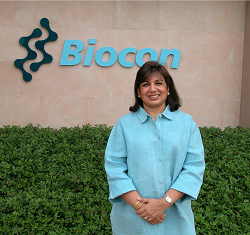

| Kiran Mazumdar-Shaw |

Indian drugmaker Biocon is on the road to taking its in-house CRO public, and the company's founder said she's considering making the company an entirely independent operation.

As Reuters reports, Biocon Managing Director Kiran Mazumdar-Shaw told investors that cashing out of Syngene, its fast-growing contractor, could give her company the money it needs to advance its pipeline. The CRO is on track to debut on the Indian exchange next week through a public offering that will see Biocon reduce its ownership stake from 85% to about 74%, generating about $95 million for the parent company.

But management may not stop there, Mazumdar-Shaw said. Syngene is doing better than ever, growing revenue about 25% over the past few years, and its promising future could prove alluring to investors and thus lucrative to Biocon, she said.

"Biocon is at a time when it needs to invest in capacity expansion of its production units," Mazumdar-Shaw told Reuters. "Syngene's margins, profitability and revenue are very, very helpful to buoy up some of Biocon's own needs."

Biocon has long touted Syngene as Asia's fastest-growing CRO, and the subsidiary has a client roster that includes Novartis ($NVS), Abbott Laboratories ($ABT), Bristol-Myers Squibb ($BMY) and Endo ($ENDP). Led by Director Peter Bains, Syngene employs about 2,300 people around the world.

In January, Biocon sold a 10% stake of Syngene to IVF Trustee Company for about $60 million, valuing the CRO at roughly $600 million.

- read the story