Abbott ($ABT) executives shed little light on the progress of its pursuit of St. Jude Medical ($STJ) and diagnostics maker Alere ($ALR) during the pharma and device giant’s 2Q conference call with analysts.

The $25 billion deal with St. Jude encountered a delay earlier this month when it reported that the FTC had requested both companies provide additional information on the proposed acquisition. The move by the regulatory agency extended the waiting period before the two companies can seal the deal by 30 days. The 30-day wait time won’t begin until both Abbott and St. Jude comply with the request.

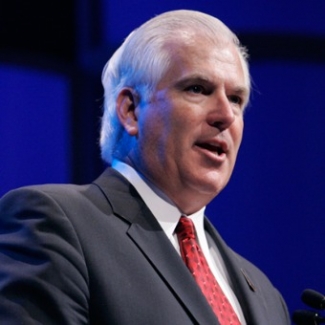

Miles White, Abbott’s chairman and CEO, told analysts’s during the call Wednesday that “everything is tracking well,” and he hopes to complete the acquisition of St. Jude before the end of the year.

“I think that will be (a) close call just as we work our way through the administrivia of the FTC's request,” White told analysts. “But I'd say there is no big surprises at all. We're just going to try and complete the work that we've already indicated and everything there is tracking according to plan.”

Though the deal with St. Jude was delayed, the $5.8 billion acquisition of Alere hit a roadblock after the diagnostic company was subpoenaed by the DOJ over questions surrounding its sales practices. In April, the company rejected a request by Abbott to nix the deal for a $50 million breakup fee.

"To be honest, no matter what kind of teeth grinding and gnashing we go through with them… one thing I'm certain of is that they are trying to do everything they can in their way to address the challenges," Miles said.

For the 2Q ended June 30, Abbott reported that net sales rose 3.2% to $5.33 billion, beating analysts' estimate of $5.24 billion. The company, on an adjusted basis, earned 55 cents per share for the period, which bettered the average analyst estimate of 53 cents, according to Thomson Reuters I/B/E/S.

Leerink, a healthcare-focused investment bank, considers Abbott stock as a Market Perform, and said in its outlook for the second half of 2016 for Abbott that despite the upbeat tone of company executives, “we continue to remain on the sidelines for now pending further clarity around integration and execution of the two pending acquisitions and building confidence in ABT's ability to successfully deliver on its projected sales and cost synergy targets.”

-here’s the Abbott earnings release

-check out a transcript of the conference call

Read more:

Abbott, St. Jude’s $25B tie-up delayed by FTC request

Can Abbott afford St. Jude and Alere? Moody’s doubts it

Alere rejects Abbott’s $50M breakup offer for megamerger deal