Merge Reports Fourth Quarter Financial Results

Merge builds momentum with significantly improved operating results, cash flow generation and launch of new advanced interoperability service in quarter

Merge Healthcare Incorporated (NASDAQ: MRGE), a leading provider of innovative enterprise imaging, interoperability and clinical systems that seek to advance healthcare, today announced its financial and business results for the fourth quarter of 2013 and provided 2014 guidance.

"We continued in 2013 to improve our solution portfolio to meet government mandates, our cash collections, our capital structure, and the alignment of our core business operations, while we also increased our recurring revenue base," said Justin Dearborn, CEO of Merge Healthcare. "Merge remains a leader in enterprise imaging and advanced interoperability, and we believe we are the only vendor that has a complete enterprise imaging and interoperability solution. We announced general availability of our new iConnect® Network for MU2, expanded our customer base with the addition of one of the largest imaging centers in the United States and announced a new strategic partnership with athenahealth. We've made enterprise imaging a reality with the addition of two new hospital clients that will deploy our latest radiology, cardiology and interoperability solutions. Our cardiology business captured top honors in the recent 2013 Best in KLAS Awards: Software & Services report. As a result, despite the lingering reimbursement uncertainty that healthcare providers face, I remain optimistic that our core enterprise solutions will continue to deliver tangible value for our customers as we deploy the iConnect Network and our clinical trials platform and grow our recurring revenue base."

Financial Summary:

- Cash generated from business operations grew to $14.2 million (51%) in the fourth quarter of 2013 from $9.4 million in the fourth quarter of 2012, which compares to net cash provided by (used in) operating activities on the statement of cash flows of $14.0 million in the fourth quarter of 2013 and ($6.0) million in the fourth quarter of 2012;

- Although sales decreased to $53.6 million ($53.9 million on a pro forma basis) in the fourth quarter of 2013, from $64.7 million ($65.1 million on a pro forma basis) in the fourth quarter of 2012, adjusted EBITDA increased in the fourth quarter of 2013 to $9.0 million, representing 17% of pro forma revenue, compared to $0.7 million and 1% in the fourth quarter of 2012;

- Subscription backlog grew 39% since the fourth quarter of 2012 (as revised), with growth in both Merge Healthcare and DNA segments;

- Net loss in the fourth quarter of 2013 was $0.3 million, or $0.00 per share, compared to $17.3 million, or a loss of $0.19 per share, in the fourth quarter of 2012; and

- We repaid $9.7 million of debt principal and achieved a leverage ratio of 5.3:1, within the 5.5:1 leverage covenant of our credit facility.

Business Highlights:

- Continued to drive a new white-space market opportunity for advanced interoperability with iConnect Network, executing agreements including the Center for Diagnostic Imaging (CDI), and its affiliated providers, which is one of the nation's largest providers of diagnostic imaging, interventional radiology and mobile imaging services;

- Added athenahealth, a leading provider of cloud-based services for electronic health records (EHR), practice management and care coordination, as a new partner for iConnect Network. athenahealth will integrate iConnect Network with athenahealth's national cloud-based platform so that athenahealth clients can receive and view exam results, diagnostic quality images and other critical patient information within the athenaClinicals® EHR workflow;

- Continued to make progress with large enterprise imaging deals, securing two significant hospital contracts valued at more than $3 million total in sales combined;

- Announced that Merge Cardio™ has been named "Best in KLAS" in the Cardiology Software Category and Merge Hemo™ has been named the "Category Leader" for Cardiology Hemodynamics for the third consecutive year in the "2013 Best in KLAS: Software & Services" report. Also, Merge was ranked in the top 10 for "Overall Software Vendor";

- Supported the conduct of 267 active clinical trials, with more than 225,000 study subjects, using the Merge eClinical OS™ platform;

- Successfully certified iConnect® Access, Merge PACS™, Merge Eye Care PACS™, Merge OrthoPACS™, Merge Cardio, Merge RIS™ and Merge LIS™ for MU; and

- Started ICD-10 readiness in all applicable Merge solutions and launched ICD-10 versions of our billing solutions.

Quarter Results:

Results compared to the same quarter in the prior year on a GAAP basis are as follows (in millions, except per share data):

| Q4 2013 | Q4 2012 | |

| Net sales | $53.6 | $64.7 |

| Operating income (loss) | 3.7 | (8.4) |

| Net loss | (0.3) | (17.3) |

| Net loss per diluted share | $0.00 | ($0.19) |

| Cash balance at period end | $19.7 | $35.9 |

| Cash from business operations* | 14.2 | 9.4 |

*See table at the back of this earnings release for a reconciliation.

Pro forma results and other, non-GAAP measures compared to the same quarter in the prior year are as follows (in millions, except percentages and per share data):

| Q4 2013 | Q4 2012 | |

| Pro forma results | ||

| Net sales | $53.9 | $65.1 |

| Adjusted net income (loss) | 3.4 | (11.6) |

| Adjusted EBITDA | 9.0 | 0.7 |

| Adjusted net income (loss) per diluted share | $0.04 | ($0.13) |

| Adjusted EBITDA per diluted share | $0.09 | $0.01 |

| Non-GAAP and other measures | ||

| Subscription, maintenance & EDI revenue as % of net sales | 64% | 58% |

| Subscription and non-recurring backlog at period end | $79.5 | $71.1 |

| Days sales outstanding | 106 | 102 |

A reconciliation of GAAP net income (loss) to adjusted net income and adjusted EBITDA is included after the financial information below.

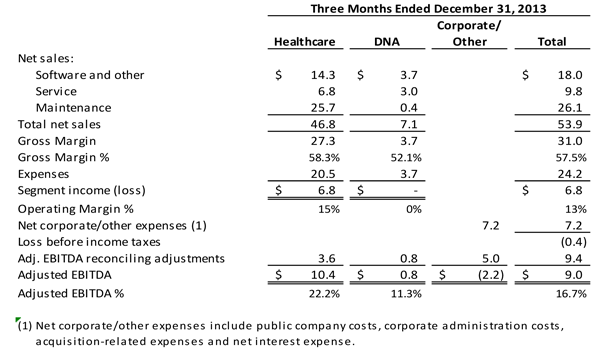

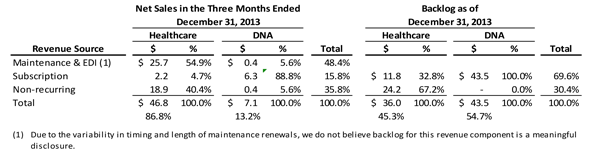

Pro Forma Operating Group Results:

Results (in millions) for our operating groups are as follows:

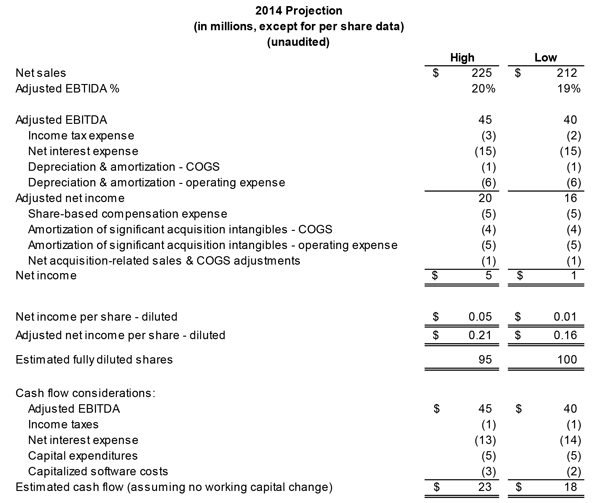

2014 Outlook:

During 2013, we exited certain low to no-margin businesses that generated approximately $14 million of revenue. Excluding those net sales, our 2013 GAAP revenue would have been approximately $218 million, which we believe is a reasonable starting point for our 2014 outlook. Looking ahead to 2014, we continue to believe that overall market conditions may delay certain large-scale perpetual-license purchases of our software, and subscription software offerings will remain a relatively small percentage of our total revenue base. As a result, our outlook for 2014 sales is essentially flat with 2013 sales for our continuing businesses, while our adjusted EBITDA is expected to improve due to the positive impact of our 2013 cost containment initiatives.

The following table outlines expectations surrounding the various items comprising the difference between GAAP net income and adjusted EBITDA:

We expect to continue to use excess cash to make voluntary debt payments in 2014. Based on our 2014 outlook, we anticipate maintaining compliance with the loan leverage covenant in our credit facility. We have already repaid $3.0 million of debt principal in January 2014.

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with generally accepted accounting principles or GAAP. This press release includes certain non-GAAP financial measures to supplement its GAAP information. Non-GAAP measures are not an alternative to GAAP and may be different from non-GAAP measures used by other companies. A quantitative reconciliation of GAAP net income available to common shareholders to adjusted net income and adjusted EBITDA is included after the financial information included in this press release.

Management believes that the presentation of non-GAAP results, when shown in conjunction with corresponding GAAP measures, provides useful information to it and investors regarding financial and business trends related to results of operations, because certain charges, costs and expenses reflect events that are not essential to recurring business operations. In addition, management believes these non-GAAP measures provide investors useful information regarding the underlying performance of the post-acquisition business operations when compared to the pre-acquisition results of Merge and any significant acquired company. Purchase accounting adjustments made in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments that are provided and discussed herein. Further, management believes that these non-GAAP measures improve its and investors' ability to compare Merge's financial performance with other companies in the technology industry. Management also uses financial statements that exclude these charges, costs and expenses for its internal budgets. While GAAP results are more complete, these supplemental metrics are offered since, with reconciliations to GAAP, they may provide greater insight into our financial results. Management does not intend the presentation of these non-GAAP financial measures to be considered in isolation or as a substitute for results prepared in accordance with GAAP.

Additional information regarding the non-GAAP financial measures presented is as follows:

- Pro forma revenue consists of GAAP revenue as reported, adjusted to add back the acquisition related sales adjustments (for all significant acquisitions) recorded for GAAP purposes.

- Subscription revenue and the related backlog are comprised of software, hardware and professional services (including installation, training, etc.) contracted with and payable by the customer over a number of years. Generally, these contracts will include a minimum volume / dollar commitment. As such, the revenue from these transactions is recognized ratably over an extended period of time. These types of arrangements will include monthly payments (including leases), long-term clinical trials, renewable annual software agreements (with very high renew rate), to specify a few contract methods.

- Non-recurring revenue and related backlog represents revenue that we anticipate recognizing in future periods from signed customer contracts as of the end of the period presented. Non-recurring revenue is comprised of perpetual software license sales and includes licenses, hardware and professional services (including installation, training and consultative engineering services).

- Adjusted net income consists of GAAP net income available to common stockholders, adjusted to exclude (a) acquisition-related costs, (b) debt extinguishment costs, (c) restructuring and other costs, (d) share-based compensation expense, (e) acquisition-related amortization (f) acquisition-related sales adjustments, and (g) acquisition-related cost of sales adjustments.

- Adjusted EBITDA adjusts GAAP net income available to common stockholders for the items considered in adjusted net income as well as (a) remaining depreciation and amortization, (b) net interest expense and (c) income tax expense (benefit).

- Cash from business operations reconciles the cash generated from such operations to the change in GAAP cash balance for the period by reflecting payments of liabilities associated with debt issuance and retirement activities, acquisitions, payments of acquisition related fees, interest payments and other payments and receipts of cash not generated by the business operations. Cash generated from business operations and used to pay restructuring initiatives, acquisition related costs and interest approximates net cash provided by operating activities in the condensed consolidated statement of cash flows.

Management has excluded certain items from non-GAAP adjusted net income because it believes (i) the amount of certain expenses in any specific period may not directly correlate to the underlying performance of business operations and (ii) the adjustment facilitates comparisons of pre-acquisition results to post-acquisition results. In addition, the following adjustments are described in more detail below:

- Debt extinguishment expense is comprised of both non-cash expenses, such as the remaining unamortized balance of costs associated with the issuance of the old debt and unamortized balance of the discount when the old debt was issued, as well as contractually owed cash charges to the holders of the old debt to allow us to retire it early. Management excludes this expense from non-GAAP net income because it believes such expense does not directly correlate to the underlying performance of operations, rather is an expense that is specific to a transaction that we would expect to occur infrequently.

- Acquisition-related amortization expense is a non-cash expense arising from the acquisition of intangible assets in connection with significant acquisitions. Management excludes acquisition-related amortization expense from non-GAAP net income because it believes such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets.

- Share-based compensation expense is a non-cash expense arising from the grant of stock awards to employees and is excluded from non-GAAP net income because management believes such expenses can vary significantly between periods as a result of the timing of grants of new stock-based awards, including grants to new employees resulting from acquisitions.

- Acquisition-related sales and costs of sales adjustments reflect the fair value adjustment to deferred revenues acquired in connection with significant acquisitions. The fair value of deferred revenue represents an amount equivalent to the estimated cost plus an appropriate profit margin to perform services-related software and product support, which assumes a legal obligation to do so, based on the deferred revenue balances as of the date the acquisition of a significant company was completed. Management adds back this deferred revenue adjustment, net of related costs, for non-GAAP revenue and non-GAAP net income because it believes the inclusion of this amount directly correlates to the underlying performance of operations and facilitates comparisons of pre-acquisition to post-acquisition results.

Notice of Conference Call

Merge will host a conference call at 8:30 AM ET on Thursday, February 20, 2014. The call will address fourth quarter results and will provide a business update on the company's market outlook and strategies for 2014.

Participants may preregister for this teleconference at http://emsp.intellor.com?p=414469&do=register&t=8. Upon registration, a confirmation page will display dial-in numbers and a unique PIN, and the participant will also receive an email confirmation with this information.

A replay via the Internet or phone will be available after the call at http://www.merge.com/Company/Investors/Conference-Call-Info.aspx.

Source: 2013 Best in KLAS Awards: Software & Services report

About Merge

Merge is a leading provider of innovative enterprise imaging, interoperability and clinical systems that seek to advance healthcare. Merge's enterprise and cloud-based technologies for image intensive specialties provide access to any image, anywhere, any time. Merge also provides clinical trials software with end-to-end study support in a single platform and other intelligent health data and analytics solutions. With solutions that have been used by providers for more than 25 years, Merge is helping to reduce costs, improve efficiencies and enhance the quality of healthcare worldwide. For more information, visit merge.com and follow us @MergeHealthcare.

Cautionary Notice Regarding Forward-Looking Statements

The matters discussed in this press release may include forward-looking statements, which could involve a number of risks and uncertainties. When used in this press release, the words "will," "believes," "intends," "anticipates," "expects" and similar expressions are intended to identify forward-looking statements. Actual results could differ materially from those expressed in, or implied by, such forward-looking statements. The potential risks and uncertainties include those risks and uncertainties included under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2012 and our most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 which are on file with the SEC and are available on our investor relations website at merge.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Annual Report on Form 10-K for the year ended December 31, 2013. Except as expressly required by the federal securities laws, Merge undertakes no obligation to update such factors or to publicly announce the results of any of the forward-looking statements.

Contact:

Jennifer Jawor

Vice President, Corporate Marketing

312.565.6825

[email protected]