We’ve reached peak biotech formation just as interest in the life sciences industry has created a talent war among executives—and it’s time for musical chairs.

For patients, there’s never been a better time for medical innovation. Investors can be choosy about where they put their money—but there’s also a lot of competition for the industry’s gems. Emerging scientists have never been in a better position to start their dream companies. And future leaders are getting a shot at the CEO job right now rather than having to slog through the pharma world and wait for an opening.

But how many biotechs is too many? We see companies launching every single day. Many of them. All claiming a ground-breaking, revolutionary breakthrough. Not all of them will make it, and success is not going to be linear for every one of them.

One of the biggest problems Arch Venture Partners co-founder and Managing Director Bob Nelsen sees from the biotech boom is that there simply aren’t enough people to support and fill out the new companies.

“There are too many biotechs to be supported by the current financing and pharmaceutical infrastructure,” Nelsen told Fierce Biotech. “The musical chairs is on, and you know, somebody is not going to have a seat.”

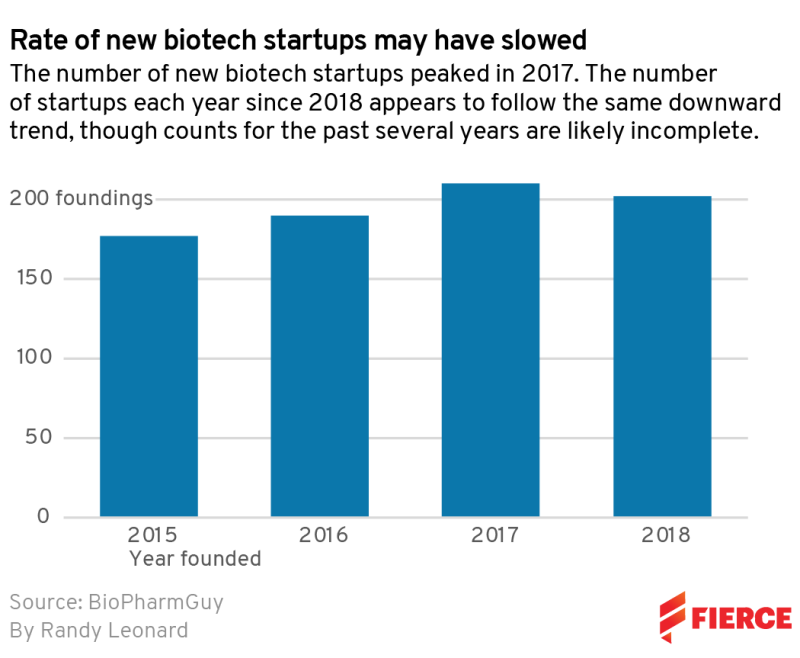

Biotech formation has been climbing steadily since about 2015. We’ll get into why a little later, but 177 companies were formed that year, according to data from BioPharmGuy. The rate of biotech births breached the 200-per-year mark in 2017 and 2018, the last year for which comprehensive data were available. Judging by how many have emerged from stealth with healthy series A rounds during the pandemic, the pace does not appear to have slowed.

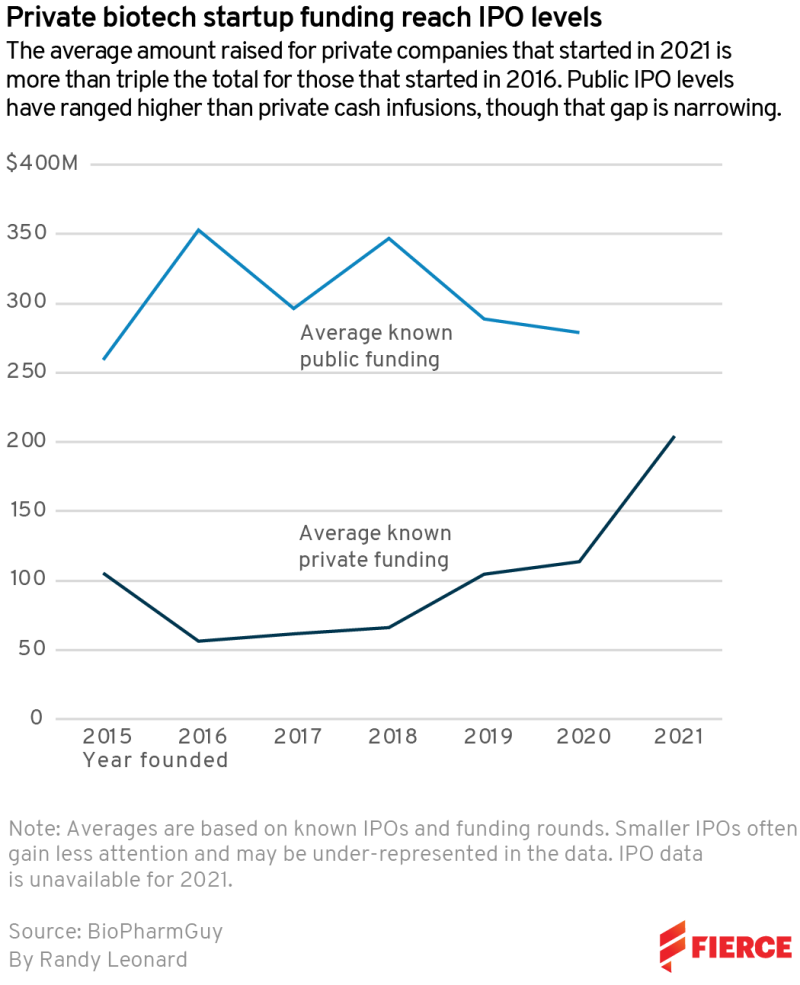

Funding, too, has gone sky-high. From 2015 to 2020, the average total funding for the companies tracked by BioPharmGuy hovered between a low of $68.6 million in 2017 to a high of $90.2 million in 2020. But 2021 blew that figure out of the water with a whopping $198.1 million in average funding as investor interest in biotech exploded.

You can also listen to Glenn Hunzinger of PwC talk about his 2023 expectations in our podcast The Top Line

Josh Schimmer, M.D., senior managing director for Evercore ISI’s biotech team, says “there's almost never such thing as too many.” However, when too many companies launch in the same disease areas, they can compete for clinical trial participants, and that slows enrollment—which could, in turn, hamper innovation.

“If you have a lot of companies, you have a lot of shots on goal to figure out what the best solution is for patients. But on the flip side, when you have that many, everyone gets a little slowed down competing for patients,” Schimmer said in an interview.

“Some of these companies have money and shitty leadership.” — Bob Nelsen, ARCH Venture Partners

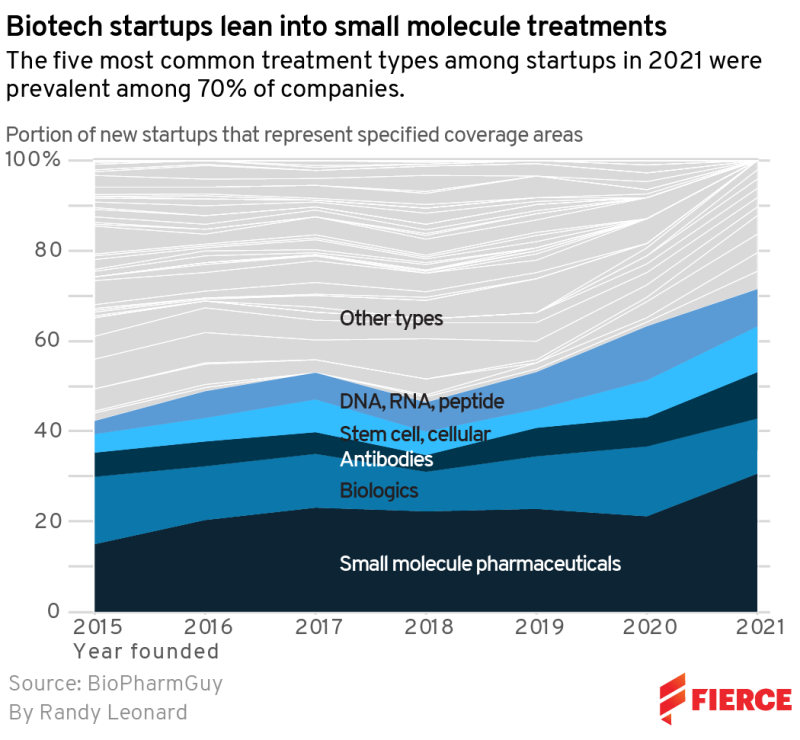

One particularly crowded area he and Nelsen noted is oncology. According to BioPharmGuy's data, small molecules are the dominant modality.

“If you’re the 35th CAR-T cell company right now, it's going to be hard, even if you have a pretty great, incremental idea,” Nelsen said. “[It’s] going to be tough to get funded.”

For Schimmer, it's not a question of whether there are too many. The question is, what's our measure of success for a new biotech company? Most likely, the answer is developing a drug that is ultimately approved and sold, providing to value to shareholders. But few startups make it all the way to that holy grail. The more likely scenario is selling the company. So, is the company a success if it merges into pharma before getting a drug onto the market?

Nelsen said there has to be attrition and consolidation at this point, especially with more experienced management teams absorbing those that are less so.

“Some of these companies have money and shitty leadership,” Nelsen said bluntly.

Companies will also need to reprice, as valuations have risen so high that even Big Pharmas like Novartis have said they’re being careful about where they splurge.

Acquisitions are how the industry works. Companies with the means swoop up the good buyout targets and add the assets to their pipelines. But Schimmer said emerging companies are focusing on smaller and smaller patient populations, which in turn lowers the market potential—and maybe cuts the price companies are willing to pay for M&A.

“We're still learning what the long-term implications are of having essentially doubled the biotech industry by value in number over the past five or six years,” Schimmer said. “We're in fairly uncharted territory.”

The major pharmaceutical companies have not been shy about their desire for M&A, after loading up their coffers with cash over the past few years—many thanks to successful COVID-19 treatments or vaccines, as in Pfizer's case. But most are looking for later-stage assets that can fill holes in their pipelines.

“They'll just try to pick off the things that already have the risk run out,” Nelsen said.

M&A will not be the journey for every biotech. Smaller companies with a similar focus may consolidate into slightly larger entities that can hang on together for the long haul. Companies with breakthroughs that fall apart will dissolve or be picked off in a reverse merger for the remaining assets.

After all, biotech has always been a sector of the “haves/have nots, winners/losers,” Schimmer said.

One dynamic to the biotech rush is the issue of pricing. Companies can compete by developing therapies with lower prices. But on the flip side, the path for a high-priced, ultra-rare disease treatment has been opened by companies such as Novartis, which markets Zolgensma, the most expensive drug in the world with a price tag topping $2 million, according to GoodRx. But the gene therapy is a one-time option for patients with the devastating genetic disorder spinal muscular atrophy.

Drugs with six-figure price tags per year have also been supported by health regulators around the world, so the option is open for a company to drop in with a treatment that costs that much, as long as it’s effective.

“There's a little chicken-and-egg dynamic there. Is it because we can now identify homogeneous groups of patients that the industry is starting to focus on them, or is it because prices of drugs are so high that those patients now can enable a viable company?” Schimmer said.

Not a light switch, but a wave

So how did we get here? Schimmer notes an inflection point around 2014 or 2015 when biotechs began to form at a faster rate. He attributes the bump to better access to capital, access to science, the improving quality of science and a lower barrier to entry for company creation.

“It's not like every grad student that wants to start a biotech is crazy,” Nelsen said. “There's probably, at a greater time than any time in history, more substance in the pipeline than ever before—and more capital.”

The world also just got more interested in biotech and what was possible for a biotech company to do, especially as the pandemic shone a light on the industry thanks to the fast—and successful—drive for COVID-19 treatments and vaccines.

“People caught on to the fact that there was an opportunity here,” Schimmer said.

There's been an inflow of people in academia moving into the corporate world and also the investing world—both in venture capital and the public markets. The industry itself is moving—physically—outside of the usual hubs of Boston and San Francisco, and startups are launching from major cities all around the world. Academic institutions are launching incubators and better supporting scientists with an entrepreneurial interest.

“It's not like a light switch. It's more of wave,” Schimmer said. “And it's been a very sizable and durable wave, and that's a testament to the much better understanding of science and biology.”

Nelsen expects a correction at some point, but good ideas will always get funded.

“It's time to take a pause. The pace is kind of unsustainable.”

Editor’s note: Startup data for this story were provided by BioPharmGuy, based on major announcements of biotech company starts, known funding rounds and other information from 2015 to now.