Months removed from a $50 million venture round, Massachusetts biotech Collegium Pharmaceutical is eyeing a $75 million IPO to get its abuse-deterrent take on oxycodone onto the market.

Months removed from a $50 million venture round, Massachusetts biotech Collegium Pharmaceutical is eyeing a $75 million IPO to get its abuse-deterrent take on oxycodone onto the market.

The company is looking to move 5.8 million shares at between $12 and $14 each, plotting to list on the Nasdaq exchange under "COLL." Collegium plans to grant its underwriters the opportunity to pick buy another 870,000 shares to cover overallotments, setting the biotech's maximum IPO value at more than $90 million.

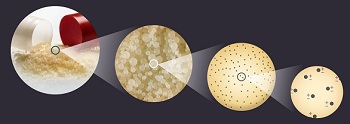

With the cash, Collegium will press forward with Xtampza ER, an extended-release formulation of the addictive oxycodone that Collegium says is crafted to make it harder to abuse. Using a proprietary technology called DETERx, Collegium's painkiller is impervious to crushing and snorting or melting and injecting, according to the company, but can still be blended with food or administered through feeding tubes for patients with difficulty swallowing.

The FDA accepted Xtampza ER's application in February, and Collegium expects to get final word on the drug by Oct. 12 thanks to the agency's fast-track program.

|

| Collegium's DETERx platform packs active ingredients in microspheres to deter potential abuse.--Courtesy of Collegium |

The promise of Xtampza ER helped Collegium put together a $50 million D round in March, a raise led by TPG Biotech and including RA Capital Management, Adage Capital Management, Rock Springs Capital, EcoR1 Capital, Eventide Asset Management and Aperture Venture Partners.

Beyond its lead candidate, Collegium is earmarking some of its new cash for pipeline therapies, including early-stage, DETERx-enabled formulations of oxymorphone, hydrocodone, morphine and methylphenidate.

- read the S-1