Nanobiotix secures financing from a major US investor, to address the US market

Plans announced to develop NBTXR3 in new indications with a global approach across Europe, Asia and now the United States

Registration of the reference document

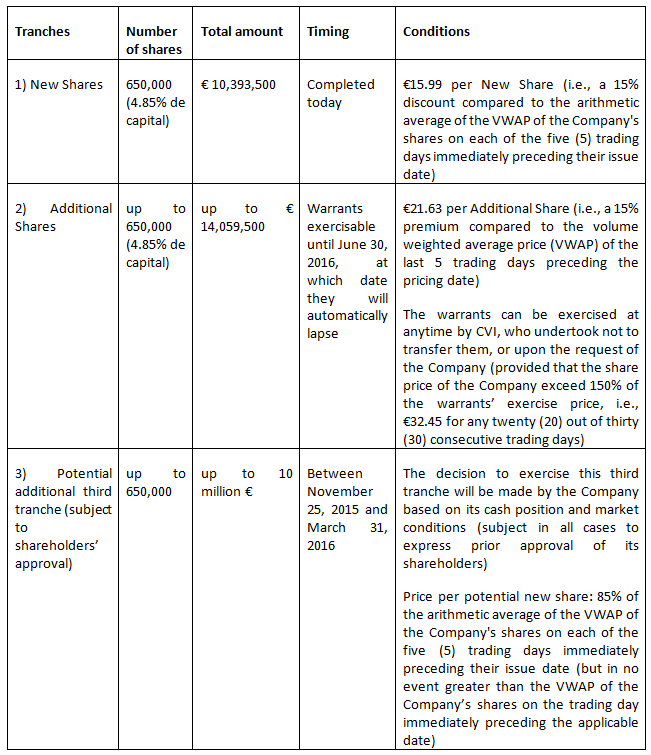

Paris, France – 25 November, 2014 – NANOBIOTIX (Euronext: NANO – ISIN: FR0011341205), a clinical-stage nanomedicine company pioneering novel approaches for the local treatment of cancer, announced today (i) the completion of a private placement with Capital Ventures International ("CVI") of new shares with warrants attached for a total amount of € 10,393,500, which may be supplemented by an amount of up to €14,059,500 in case of exercise of all the warrants, (ii) CVI's commitment to purchase an additional tranche of up to € 10 million that the Company may issue in its discretion (subject to any required corporate authorizations) under the terms and conditions described below, (iii) the Company's new global development plan and (iv) the registration with the French Autorité des marchés financiers (AMF) of the Company's reference document, which has been updated with the information relating to the Company's business to date.

- Nanobiotix is now in position to expand its clinical development program and intends to develop new high potential indications in both US and EU, in parallel with the soft tissue sarcoma registration clinical trial and Head and Neck cancer trial already underway in Europe.

- In order to preserve both the company's and its shareholders' interests, Nanobiotix intention is to realize a higher value, before seeking a potential partnership for the US market. With a more developed product, a future potential deal would be based on a higher value, and therefore would be more beneficial.

- The arrival of a US based major shareholder is in line with the company's strategy and the capital evolution at international level.

As previously announced, Nanobiotix is pursuing a standalone development and commercialization strategy for its lead product NBTXR3 in Europe. Today, the Company announces its intention to adopt a similar independent strategy for the development of NBTRXR3 in the United States.

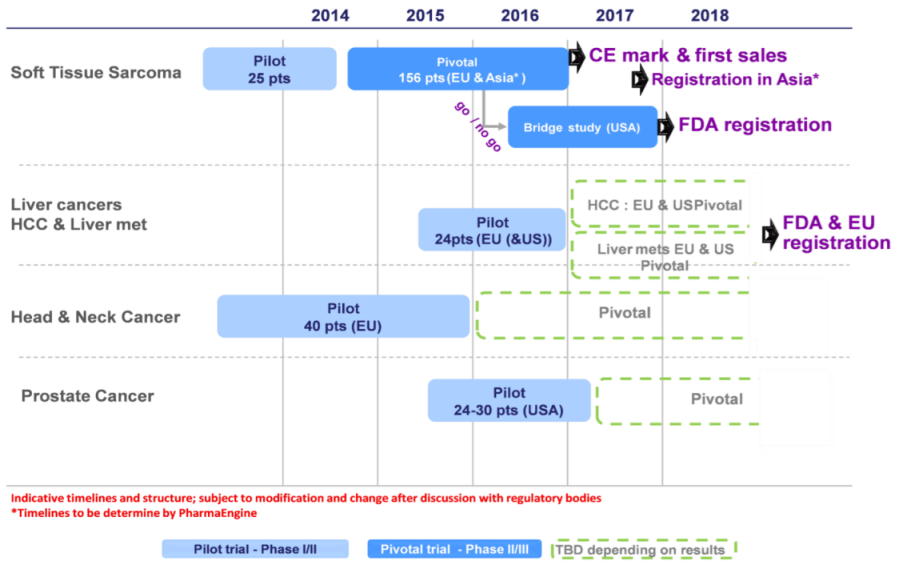

The primary indication to bring NBTXR3 to the European market is in soft tissue sarcoma. The global clinical development plan now includes a larger number of therapeutic indications: head and neck cancer, metastatic liver cancer, hepatocellular carcinomas and prostate cancer. Those last two new indications would represent the largest markets to be targeted. More details about the development plan are provided below.

The aim of this broader strategy is to increase the value of NBTXR3 and retain greater medium and long-term value in the Company for its shareholders, before evaluating potential partnerships for its development and/or commercialization. In the Asia-Pacific region, Nanobiotix is already partnered with PharmaEngine for NBTXR3.

Laurent Levy, CEO of Nanobiotix said:

"Today, thanks to this new step, we are extending our international ambitions. We believe that it is important to develop our product ourselves for the US market, thereby retaining the value created in the Company. We also see that the broadening of the therapeutic indications provides multiple opportunities for our nanomedicine approach which has significant potential to change the way cancer is treated. The substantial investment of €10,393,500 from Capital Ventures International, a large and recognized US investor, supports this ambitious business strategy, and further strengthens and internationalizes our shareholder base. This is a major step for our future growth."

1. New plans for the global development of the Company's nanomedicine products

Nanobiotix is increasingly focused on preparing the pivotal phase for its lead product NBTXR3 for patients with soft tissue sarcoma, before registration which is planned for 2016. Beyond this first main value driver, today's announcement details how Nanobiotix aims to develop new indications, and also at addressing new territories, in a broader and more aggressive plan.

The recently opened Nanobiotix affiliate in Cambridge will play a key role in the company's US development plan.

First indication to market Europe and Asia

Soft tissue sarcoma

Nanobiotix is developing NBTXR3 in soft tissue sarcoma in Europe. The registration study has started in Europe and a CE mark is anticipated in 2016.

PharmaEngine is jointly developing the Asia Pacific component of the registration trial.

Depending on the interim clinical results, expected in H1 2016, the Company will decide whether a bridging study will be necessary in order to address the US market.

Broadening indications and geographical markets for NBTXR3, including United States, Europe and Asia

Liver cancers (Metastases and Hepatocellular)

Nanobiotix is planning to investigate whether NBTXR3 could be used for local treatment of liver cancers, including different patient population such as hepatocellular carcinoma (HCC) and liver metastases (arising from colorectal cancer, breast cancer…). The Company plans to initiate the pilot clinical trial in these cancers at the beginning of H2 2015. This trial should include between 24 to 32 patients.

The medium term goal is to develop this indication both in Europe and the United States, to establish the value of the product, thanks to the demonstration of the prolongation of patients' life.

The inclusion of liver metastases in the scope of NBTXR3 would more than double the total potential population that this product could be prescribed to, as more than 300,000 additional patients in the top five European countries, the US and Japan markets could benefit from NBTXR3. If this is the case, this indication would have the biggest potential market for NBTXR3.

Prostate cancer

The Company is also seeking to use NBTXR3 in patients with high risk prostate cancer with the aim of providing effective tumor control combined with tumor destruction. The benefits for patients would be to avoid local relapse or distant invasion and to preserve genito-urinary function. The planned pilot trial is expected to start in H2 2015. It will involve approximately 24-30 patients with high-risk prostate cancer that has been newly diagnosed, or that results from a first surgical therapeutic failure.

Head and Neck cancer

A head and neck cancer clinical study is already underway in Europe. Nanobiotix opened two new sites for this clinical trial in Spain, and will publish interim results in H1 2015. In 2016, depending on the results, Nanobiotix will decide whether to accelerate development and launch a registration trial in the EU and US.

Development in Asia

PharmaEngine joined Nanobiotix's pivotal trial for NBTXR3 in soft tissue sarcoma to accelerate its development in Asia-Pacific.

Nanobiotix and PharmaEngine are collaborating in liver cancer development which is a major health problem in Asia.

NBTXR3 could be also developed in other indications as the potential is broad especially for head and neck cancer, esophagus cancer, glioblastoma, cervix cancer, etc.

2. Terms of the private placement

Philippe Mauberna, CFO, commented:

"The deal, the new investor and the money raised allow us to finance our ambitious and enlarged development plan, in Europe and the United States, toward our first commercialization and beyond. The structure of this deal and its flexibility enable Nanobiotix to optimize its valuation and cash position. Having chosen a unique and well known investor, contributes to structure our capital. "

The private placement was carried out in accordance with article L. 411-2 II of the French monetary and financial code, article L. 225-136 of the French commercial code and the 16th and 17th resolutions of Nanobiotix' general shareholders meeting held on June 18, 2014.

A total of 650,000 ordinary shares (the "New Shares") were issued to CVI in the private placement, representing around 4.85% of the outstanding shares prior to the private placement.

In accordance with the 17th resolution of Nanobiotix' general shareholders meeting held on June 18, 2014, the price of the placement has been set at €15.99 per New Share. This price represents a 15% discount to the volume weighted average price (VWAP) of the last 5 trading days preceding the pricing date.

One warrant is attached to each New Share, entitling CVI to subscribe, at any time and in one or more installments until June 30, 2016, for one additional share per warrant, i.e. a maximum of 650,000 additional ordinary shares (the "Additional Shares") at a price of € 21.63 per share (i.e., 115% of the arithmetic average of the VWAP of the Company's shares on each of the five (5) trading days immediately preceding the pricing date). The warrants will be immediately detached (détachés) from the New Shares as from their issuance and will be credited in registered form (nominatif). The Company may require CVI to exercise the warrants if the daily VWAP of the Company's ordinary shares shall exceed 150% of the exercise price of the warrants, i.e., € 32.45, for any twenty (20) out of thirty (30) consecutive trading days before the expiration of the warrants.

The warrants' exercise price will be automatically adjusted downwards (but not to be less than 95% of the arithmetic average of the VWAP of the Company's shares on each of the five (5) trading days immediately preceding the pricing date) in the event of any subsequent new issue of shares or securities giving access to the capital of the Company on the basis of a price per share lower than the exercise price of the warrants (excluding any options or other incentive shares to employees and executives of the group not to exceed 5% of the capital).

Finally, CVI has committed (subject to certain conditions) to purchase a third tranche of up to 10 million € of additional ordinary shares, not to exceed 650,000 shares, if the Company shall decide in its discretion to issue them to CVI in the period from November 25, 2015 to March 31, 2016, at a price equal to 85% of the arithmetic average of the VWAP of the Company's shares on each of the five (5) trading days immediately preceding their issue date, but in no event greater than the VWAP of the Ordinary Shares on the trading day immediately preceding the applicable date.

Piper Jaffray & Co. and its affiliates served as sole lead placement agent and Trout Capital served as co-placement agent for the private placement.

Use of proceeds

Nanobiotix intends primarily to use the proceeds from the placement for the following purposes:

- The expansion of the NBTXR3 portfolio by launching a larger Phase I/II studies in Liver (including both HCC and liver Met patient population). New phase I/II on Prostate. The objective in both indication is to target US and EU market

- The Completion of a preclinical package to comply with FDA requirements

- The potential development of STS indication in the Unites-States, depending on intermediary European results through a bridge study

- The preparation of a market access plan for commercialization of NBTXR3 in EU and registration in US

- The building US capabilities with local recruitments

Settlement and admission to listing of the New Shares

The settlement of the New Shares is expected to take place on or before December 1st.

The New Shares, with a nominal value of € 0.03, will be of the same category and will be listed on the same line as the existing shares of the Company under ISIN code FR0011341205. They will carry the same dividend rights as the existing shares from the date of their issuance. Application will be made to list the New Shares on Euronext Paris.

Lock‐up and other agreements

In connection with the private placement, the Company has agreed not to issue more shares or other equity securities (subject to standard exemptions including stock options) for a period ending 9 months following the issue of the New Shares as well as of the Additional Shares, as the case may be.

The Company has also granted certain other protections to CVI in connection with the warrants, in the event of any transaction leading to change in control (e.g., mergers or tender offers).

Public information

Nanobiotix announces the registration of its reference document (document de référence) with the French Autorité des marchés financiers (AMF) today under number R.14-071.

Copies of the reference document are available free of charge at Nanobiotix' head office, 60 rue de Wattignies 75012 Paris and on the Nanobiotix website (www.nanobiotix.eu) and AMF website (www.amf-france.org).

Nanobiotix draws investors' attention to chapter 4 ("Risk factors") of the reference document.

Notes for Editors:

About NANOBIOTIX: www.nanobiotix.com

Nanobiotix (Euronext: NANO / ISIN: FR0011341205) is a clinical-stage nanomedicine company pioneering novel approaches for the local treatment of cancer. The Company's first-in-class, proprietary technology, NanoXray, enhances radiotherapy energy with a view to provide a new, more efficient treatment for cancer patients. NanoXray products are compatible with current radiotherapy treatments and are meant to treat a wide variety of cancers (soft tissue sarcoma, breast cancer, liver cancer, head and neck cancer, glioblastoma, prostate) via multiple routes of administration.

Nanobiotix's lead product NBTXR3, based on NanoXray, is currently under clinical development for soft tissue sarcoma and locally advanced head and neck cancer. The Company, based in Paris, France, has partnered with PharmaEngine for clinical development and commercialization of NBTXR3 in Asia.

Nanobiotix is listed on the regulated market of Euronext in Paris (ISIN: FR0011341205, Euronext ticker: NANO, Bloomberg: NANO: FP).

Issued for and on behalf of Nanobiotix by Instinctif Partners.

For more information please contact [email protected]

Disclaimer

This press release contains certain forward-looking statements concerning Nanobiotix and its business, including the Company's strategy, plans for the global development of the Company's products, investment plans and calendar for regulatory events, the market potential for certain products, as well as other forward looking information and statements. Such forward-looking statements are based on assumptions that Nanobiotix considers to be reasonable. Such forward-looking statements are, by their nature, subject to a number of important risks and uncertainties, such as those described in the in the reference document of Nanobiotix registered today with the AMF under number R.14-071 (a copy of which is available on www.Nanobiotix.com) and to the development of economic conditions, financial markets and the markets in which Nanobiotix operates. These forward-looking statements are also subject to risks not yet known to Nanobiotix or not currently considered material by Nanobiotix. The occurrence of all or some of such risks, or other events, could cause actual results, financial conditions, performance or achievements of Nanobiotix to be materially different from the plans, objectives and expectations expressed or implied in such forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and Nanobiotix undertakes no obligation to update or revise any of them, whether as a result of new information, future events or otherwise, except as required by law.

This press release is for information purposes only and does not, and shall not, in any circumstances, constitute a public offering by Nanobiotix nor a solicitation of an offer to subscribe for securities in any jurisdiction, including France.

In particular, this press release and the information contained herein do not constitute an offer or solicitation of an offer to subscribe for securities in the United States or any other jurisdiction. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"). The shares of Nanobiotix have not been and will not be registered under the U.S. Securities Act and Nanobiotix does not intend to register securities or conduct a public offering in the United States.

With respect to the member states of the European Economic Area which have implemented the Directive 2003/71/EC of the European Parliament and the Council of November 4, 2003, as amended, in particular by Directive 2010/73/EC of the European Parliament and of the Council of November 24, 2010 (the "Prospectus Directive"), no action has been undertaken or will be undertaken to make an offer to the public of the securities referred to herein requiring the publication of a prospectus in any relevant member state.

In the United Kingdom, this document is only being distributed to, and is only directed at, persons that are "qualified investors" within the meaning of Article 2(1)(e)(i), (ii) or (iii) of the Prospectus Directive and that also (i) are "investment professionals" falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the "Order"), (ii) are persons falling within Article 49(2)(a) to (d) ("high net worth companies, unincorporated associations, etc.") of the Order, or (iii) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as "relevant persons"). In the United Kingdom, this document must not be acted on or relied on by persons who are not relevant persons.

In accordance with Article 211-3 of the General Regulation of the AMF, the above-mentioned private placement does not require a prospectus to be submitted for approval to the AMF.

The distribution of this press release in certain countries may be subject to specific regulations. Any person who comes into possession of this press release must inform him or herself of and comply with any such restrictions.