|

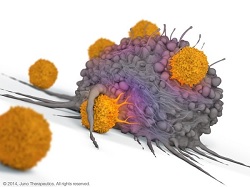

| Illustration of CAR-T technology--Courtesy of Juno |

CAR-T contender Juno Therapeutics ($JUNO) is settling in for the long haul in a race to commercialize new immunotherapies for cancer, buying up a European biotech to firm up its process on the way to late-stage development.

Juno is trading €52.5 million ($59 million) in cash and about $22 million of its own shares for Stage Cell Therapeutics, a German company devoted to the engineering and manufacturing of cell therapies. Juno's top candidates are so-called CAR-T treatments, crafted by removing a patients' own T cells and rewiring them to home in on cancers. And the biotech, barreling toward Phase III, is buying Stage Cell with an eye on building a commercial-scale operation.

Under the deal, Juno gets Stage Cell's two operations in Munich and Göttingen, staffed by 23 scientists, engineers and other personnel. Juno plans to operate the company as a German subsidiary, promising Stage Cell's shareholders another €135 million ($152 million) tied to down-the-road development and commercialization milestones.

The deal comes a few months after Juno leased a manufacturing facility in its native Washington in an effort to vertically integrate its business. That operation is slated to come online in the next year, according to the company, in time to churn out doses of the blood cancer-treating JCAR015 as it enters late-stage trials.

The complexity of engineering cell therapies makes manufacturing and process development better handled in-house than through contractors, according to Juno, and the biotech's plan to take a slew of candidates through clinical development will depend on its ability to reliably generate modified T cells. And Juno, planning to get 10 more candidates into clinical trials this year, is extending the same philosophy through the Stage Cell deal.

|

| Juno CEO Hans Bishop |

"This important acquisition is driven by our strategy to have best-in-class process development and manufacturing capabilities in support of our goal of developing next generation CAR and TCR products," CEO Hans Bishop said in a statement. "We welcome our new colleagues in Germany to the Juno family, and we look forward to working together to develop and commercialize best-in-class therapies."

Juno's principal rivals have taken similar steps, with global giant Novartis ($NVS) investing in manufacturing and development and smaller contenders Kite Pharma ($KITE) and Bellicum Pharmaceuticals ($BLCM) spending on in-house infrastructure.

For Juno, the buyout caps a busy dealmaking season, following an agreement with AstraZeneca ($AZN) that will pair that company's promising checkpoint inhibitor with one of Juno's CAR-Ts in a combo trial and a tie-up with Fate Therapeutics ($FATE) designed to discover new immunotherapies. And that pace is a good sign for Juno as it stretches out its influence in a fast-moving space, according to Leerink analyst Howard Liang.

"Together, we believe these collaborations allow Juno to remain on the cutting-edge of adoptive T cell technology, which will be essential as the field moves to treating solid tumors," Liang wrote in a note to investors.

- read the statement